Bitcoin Price Analysis: Testing Support Levels

Key Points:

- Bitcoin tested the $92,000 level after a drop from $102,000 due to increased selling pressure.

- Macroeconomic factors are raising concerns about market strength, with inflation being a significant worry.

- Spot crypto ETFs saw significant outflows post the release of Fed meeting notes.

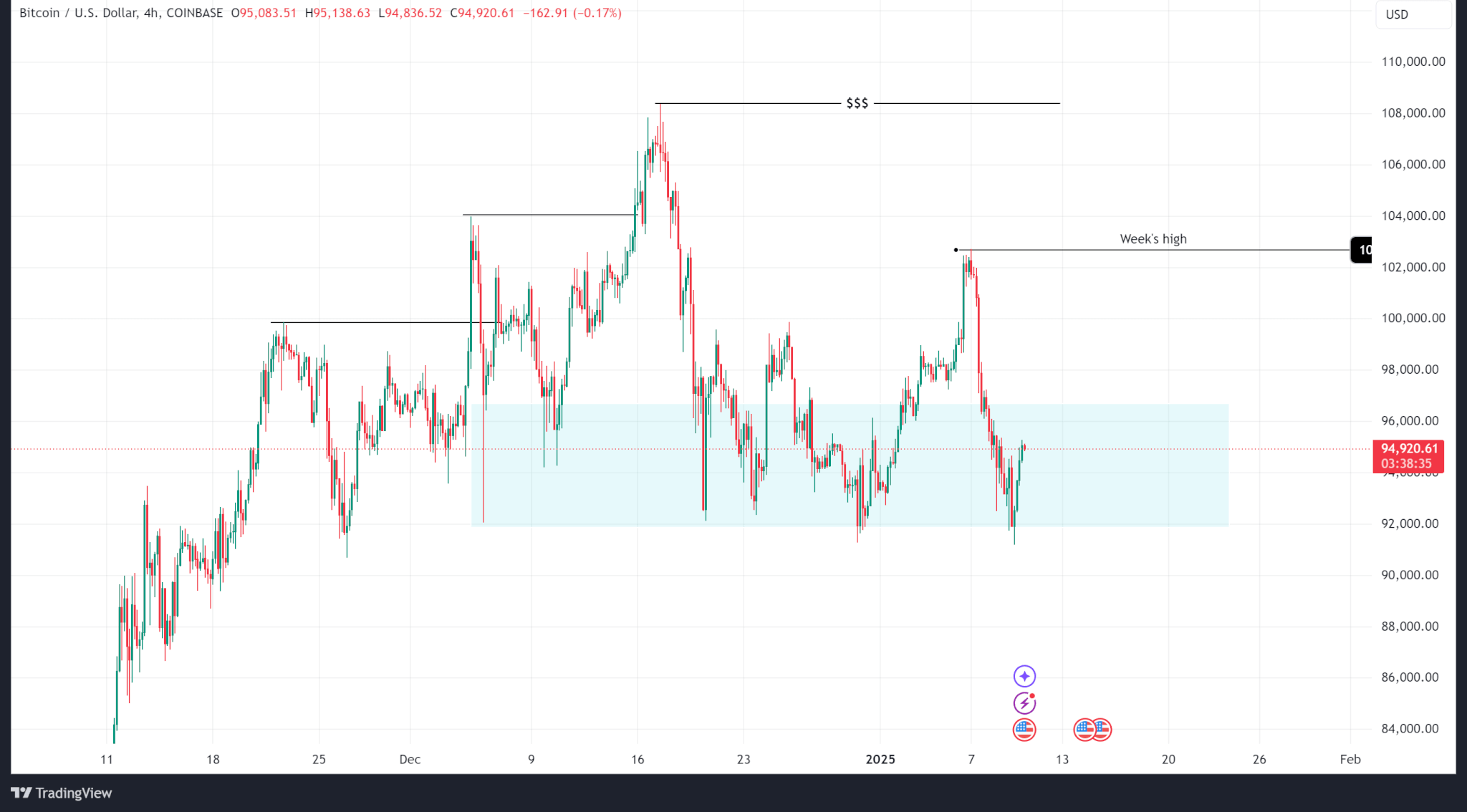

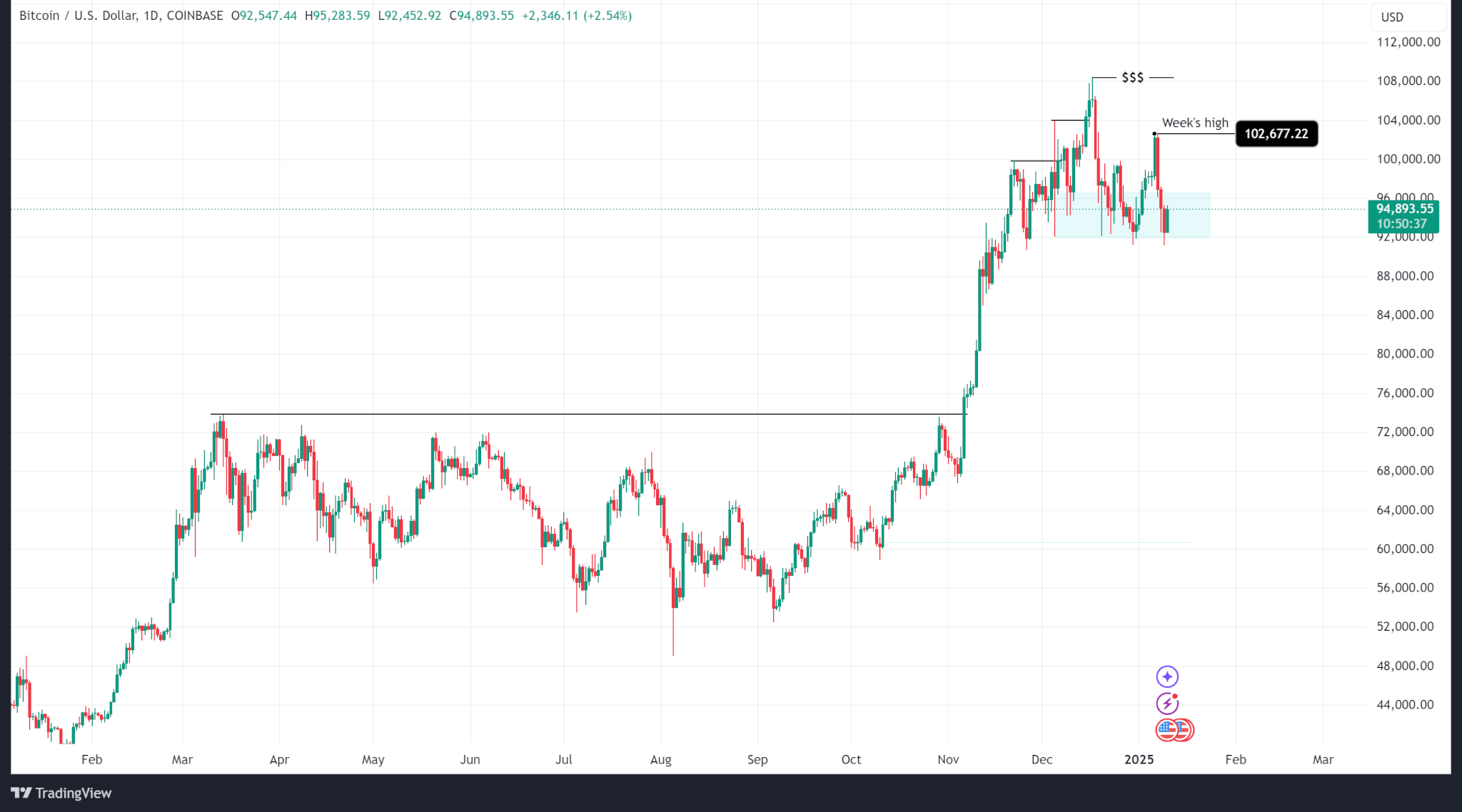

Bitcoin’s price has retreated from a recent high of $102,667 to $94,890 at the time of writing, remaining within the H4 demand zone.

Technical Analysis:

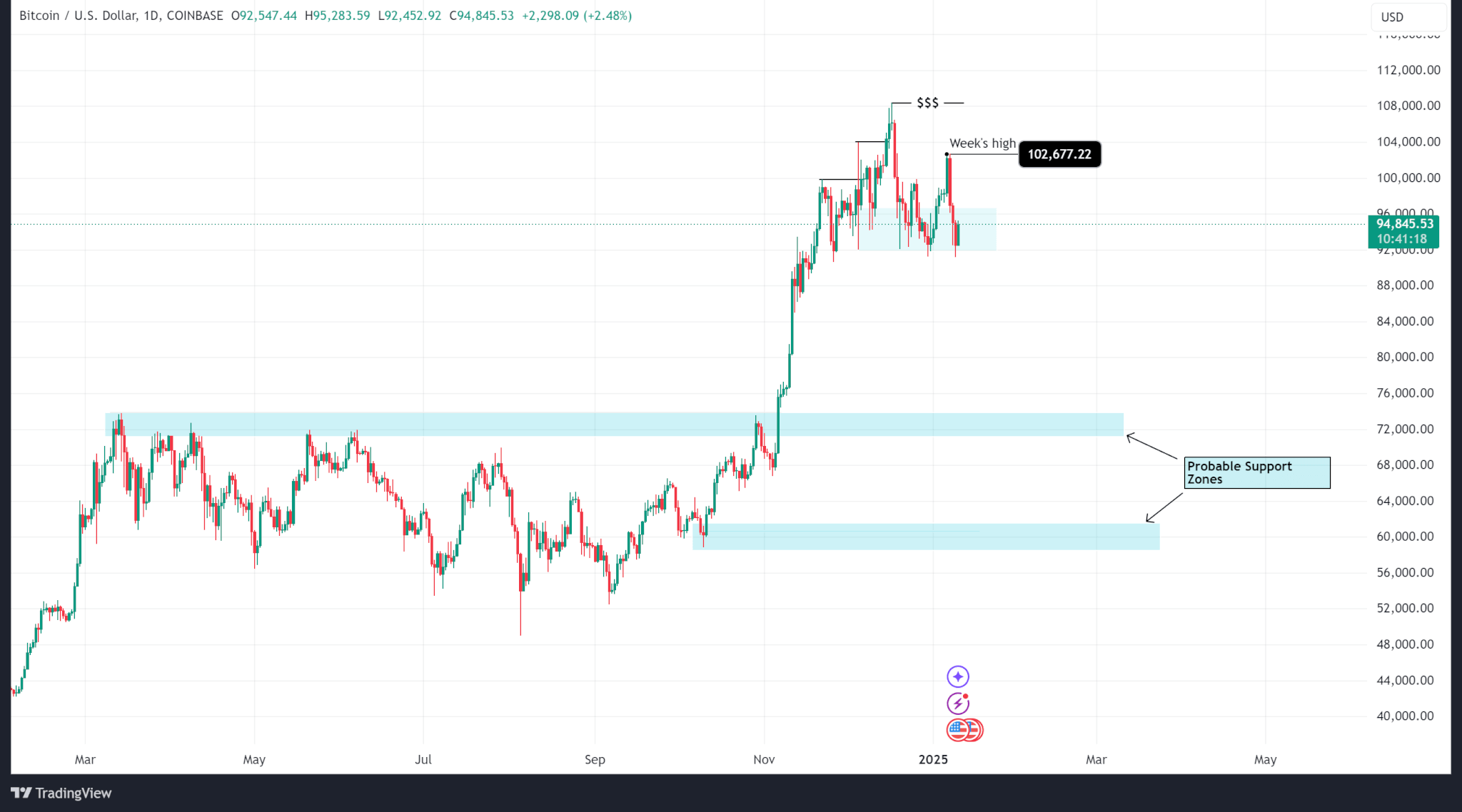

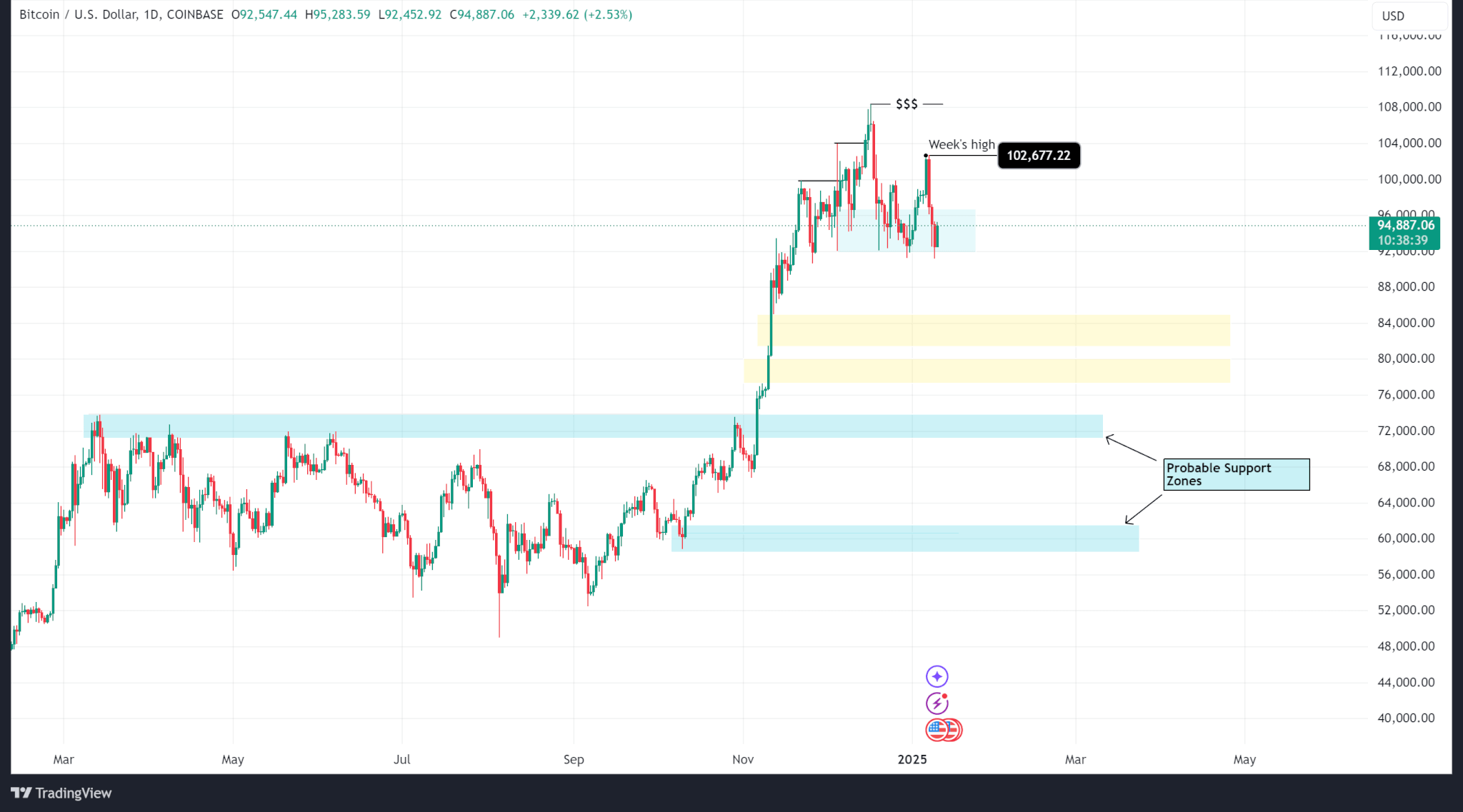

While $92,000-$97,000 acts as a crucial support range on the H4 timeframe, the broader daily view shows Bitcoin in a premium zone. Even a dip below $92,000 would keep the price in bullish territory overall.

The ideal buy levels are either at the last structure break on the daily timeframe or the 50% Fibonacci retracement level.

There are two fair value gaps that could influence price action, potentially leading to a move towards $108,000 or a temporary relief rally before further downside.

However, all of this hinges on Bitcoin breaching the $91,000 mark.

Market Insights:

Spot crypto ETFs witnessed outflows following the Fed meeting minutes, indicating caution towards inflation and potential policy impacts.

BTC ETFs saw a $568.8 million drain, while ETH ETFs lost $159.4 million, with Fidelity experiencing the largest outflows.