Crypto Investments Surge to Record Highs in 2024

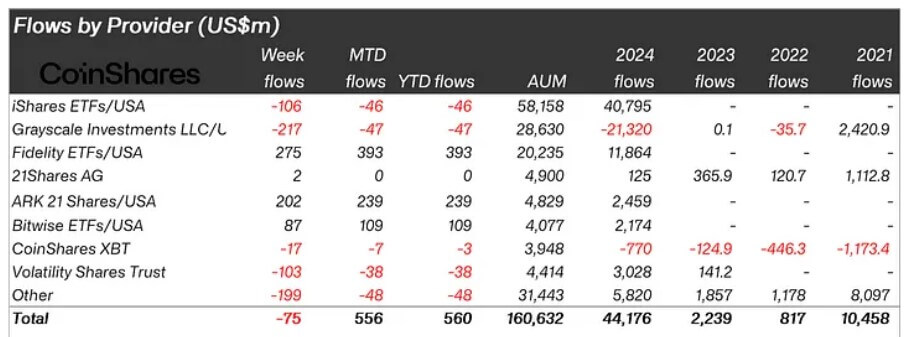

In 2024, crypto-related products saw an unprecedented influx of $44.2 billion, a staggering increase compared to the previous high of $10.5 billion in 2021. CoinShares’ latest report attributes this remarkable performance to the introduction of US spot-based exchange-traded funds (ETFs), which had a significant impact on global investments.

Bitcoin ETFs Lead the Way

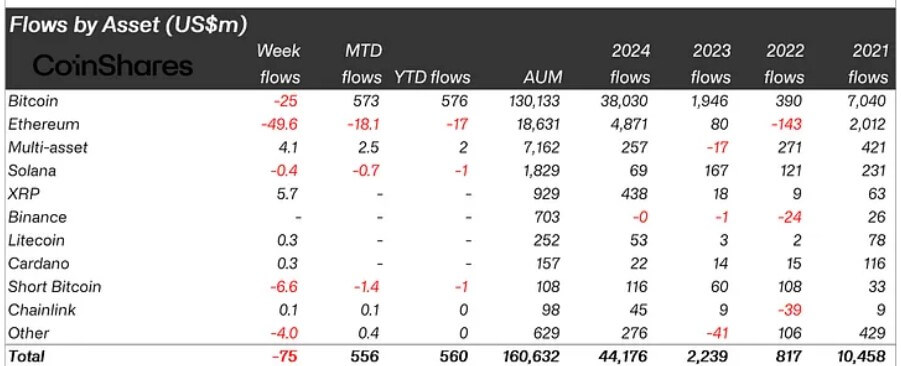

- Bitcoin dominated the market, attracting $38 billion in inflows and representing 29% of total assets under management (AuM).

- The influx of funds led to a substantial increase in Bitcoin ETF holdings, surpassing one million BTC within a year of their launch.

- Popular products like BlackRock’s IBIT and Fidelity’s FBTC garnered the most attention, with IBIT becoming the most successful ETF launch in the past decade.

On the flip side, Grayscale’s GBTC experienced significant outflows last year, with investors withdrawing over $21 billion from the fund in favor of more cost-effective alternatives. Despite this, the positive flow of ETF products propelled the US to the forefront of global inflows, capturing almost all of the $44.4 billion, followed by Switzerland with $630 million.

Ethereum Makes a Comeback

Ethereum also shone in 2024, particularly in the latter part of the year. The digital asset attracted $4.8 billion in inflows, with its ETH spot-based ETFs finishing the year on a high note. This influx accounted for 26% of its AuM, marking a significant increase from previous years.

While Ethereum’s gains outpaced those of Solana, other major alternative coins like Polkadot, Cardano, and XRP collectively attracted $813 million, representing 18% of their AuM.

2025 Outlook

2025 has kicked off positively for Bitcoin investment products in the US, with inflows reaching $666 million in the first two trading days. Farside data shows a $908 million inflow on Jan. 3 alone, with Fidelity leading at $357 million, closely followed by BlackRock and Ark Invest.