Bitcoin’s Price Drops After Long Liquidations

Bitcoin’s recent peak at $108,200 was short-lived as its price quickly dropped by over 12% to $95,000 in less than a week.

Long Liquidations Cause Selling Pressure

- Between Dec. 17 and Dec. 22, over $540 million in long positions were liquidated.

- Dec. 19 saw the largest single day for liquidations with approximately $214 million in longs wiped out.

Impact of Overleveraged Trading

- Forced liquidations of high-leverage long positions added to selling pressure.

- Bitcoin’s decline below $100,000 accelerated by liquidation cascade.

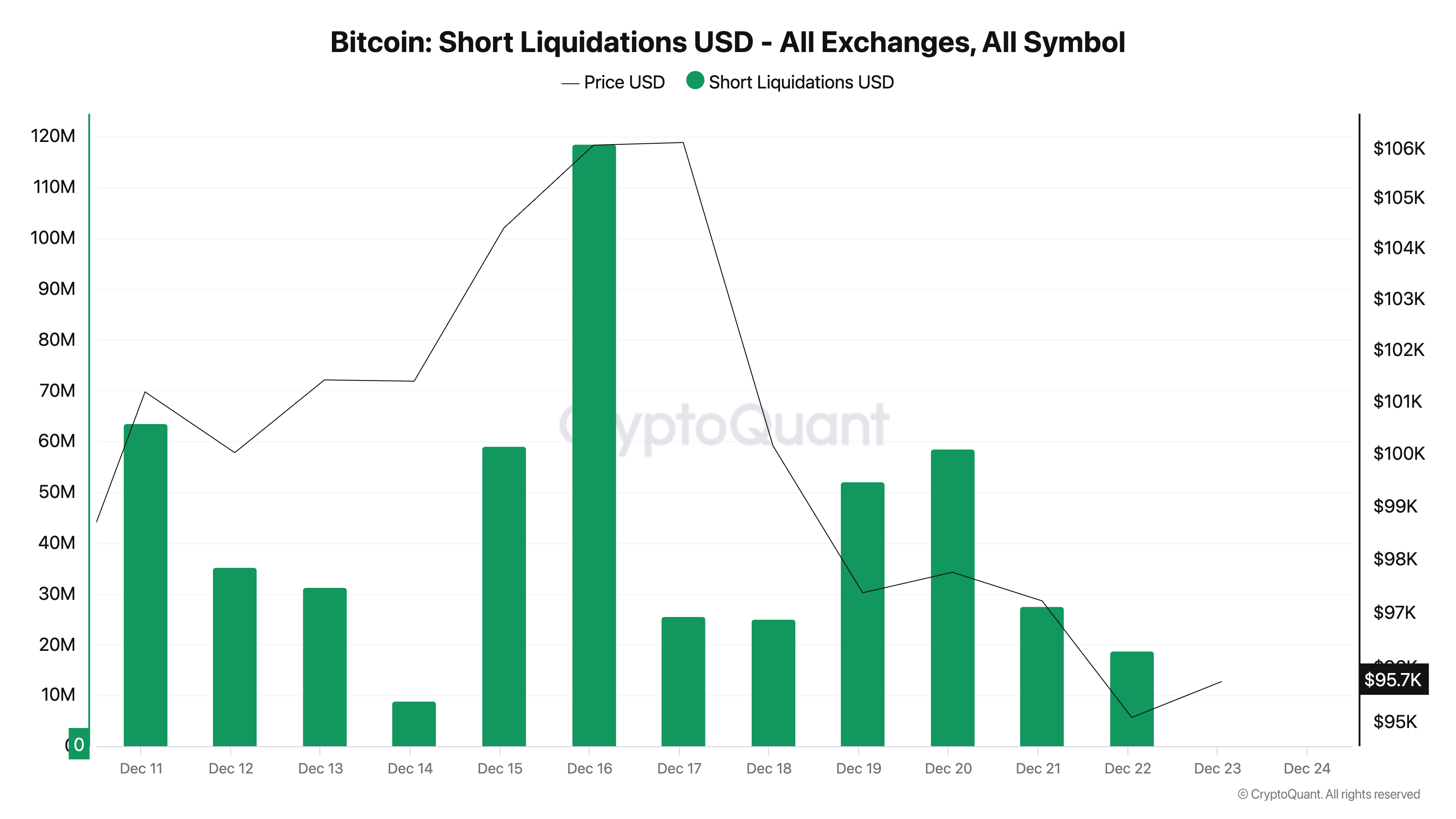

Short Liquidations During Price Spike

- Approximately $120 million in short positions were liquidated on Dec. 16 as Bitcoin surged.

- Rapid price increase led to short squeeze and upward pressure on price.

Role of Leverage in Market Movements

- Long liquidations far exceeded short liquidations, reflecting a shift in market sentiment.

- Short liquidations peaked during rally while long liquidations intensified during sell-off.

Overall, Bitcoin’s recent rally and subsequent drop were heavily influenced by leveraged positions, showcasing the impact of liquidations in shaping price movements in the cryptocurrency market.

The post Bitcoin tumbled to $95k after $540 million in long liquidations appeared first on CryptoSlate.