The Rise of Bitcoin Options Trading

The Bitcoin options market has seen significant growth in size and popularity, making it a valuable tool for assessing market sentiment and predicting volatility. Recent analysis has shown that options play a crucial role in influencing Bitcoin’s price movements and driving volatility in the market.

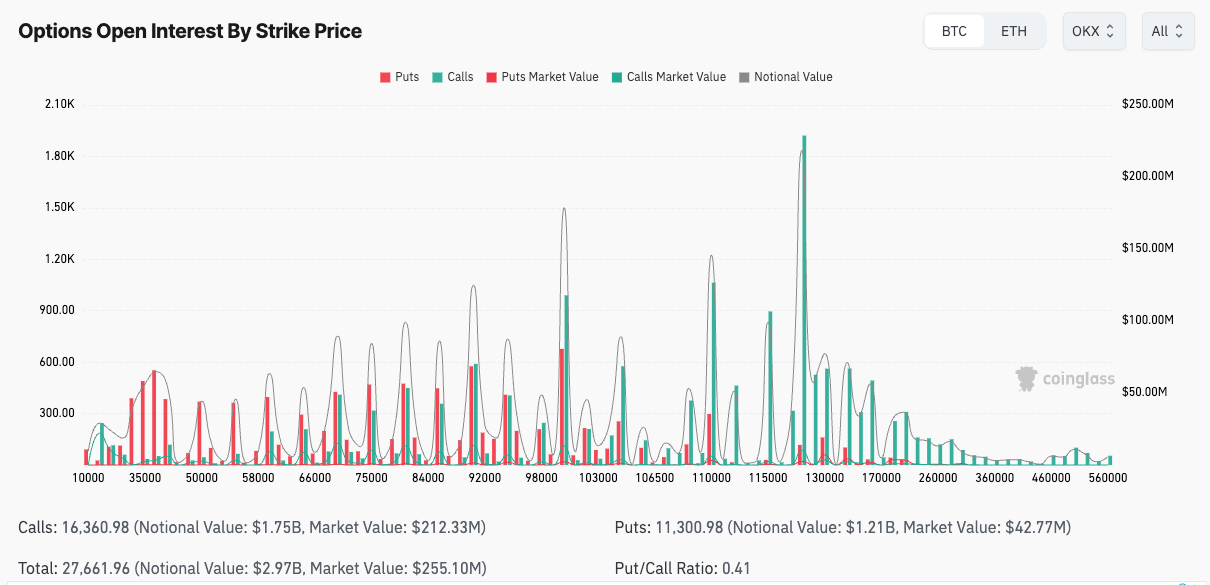

Concentration of Open Interest at $120,000 Strike Price

- Options data reveals a major concentration of open interest at the $120,000 strike price for contracts expiring at the end of the year.

- Traders have shown a strong interest in this particular strike, with over $640 million in open interest on Deribit alone.

- The heavy focus on the $120,000 strike indicates optimism for a price increase but also suggests the possibility of high volatility in the near future.

Delta Analysis for $120,000 Strike Price

- The delta for the $120,000 strike expiring on December 27 is approximately 0.10, suggesting a 10% chance of Bitcoin reaching or surpassing this price by the end of the year.

- Delta is a key options metric that represents the sensitivity of an option’s price to changes in the underlying asset, providing insight into the probability of certain price levels being achieved.

Market Trends and Speculative Activity

- Options trading provides insight into market sentiment and volatility expectations, with a focus on key strike prices indicating significant levels for traders.

- Deribit’s dominance in the Bitcoin options market highlights the preference for crypto-specific platforms among traders, particularly for high-strike calls.

Institutional vs. Retail Participation

- Deribit’s options data reflects a higher appetite for risk among crypto-native traders compared to more conservative institutional positioning seen on platforms like CME.

- Monitoring multiple platforms is essential for a comprehensive analysis of options market trends, with Deribit setting the tone for Bitcoin options activity.

Anticipating Volatility and Market Risk

- Options strike price data and open interest levels offer valuable insights into how traders are pricing risk and anticipating market volatility.

- The concentration of activity at distant strikes suggests expectations for significant price swings and potential extreme moves in Bitcoin’s price.

Overall, options traders are making significant bets on Bitcoin reaching $120,000 despite low odds, indicating a strong belief in potential price movements in the near future.