Understanding the Impact of Options on Bitcoin’s Volatility

Options are a key market indicator that reflects traders’ expectations for price movements and volatility. In the case of Bitcoin, the derivatives market plays a significant role in shaping the price direction due to its size and influence.

Complexity of Options Trading

Unlike futures, options trading involves strategies that hedge risks and speculate on both price and volatility. This complexity makes any changes in the market, such as open interest, volume, or the options/futures ratio, impactful on Bitcoin’s price.

Options Dominance in Derivatives Market

Options have become a dominant force in the derivatives market, influencing periods of increased price volatility. The options/futures open interest ratio indicates the influence of options traders relative to futures and perpetual contracts, highlighting their role in price discovery.

Market Activity and Price Movements

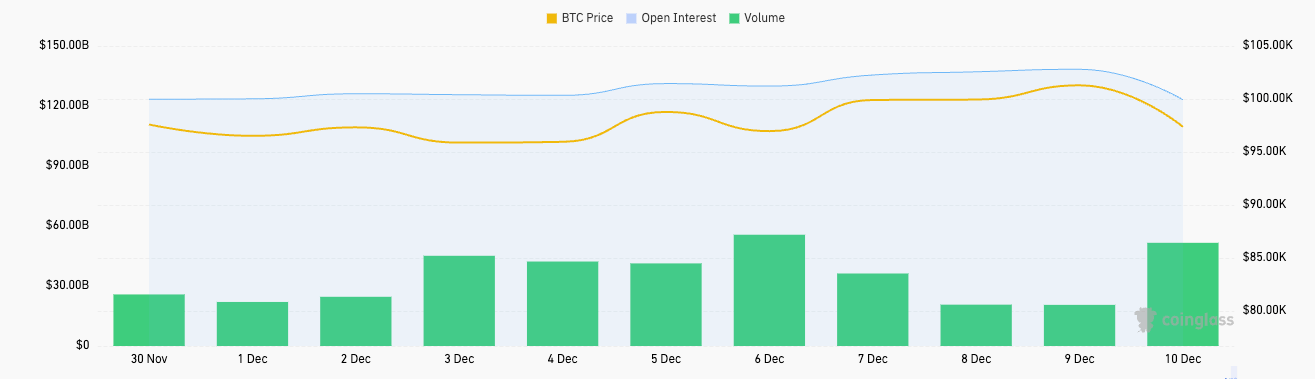

Analysis of open interest and trading volume data from CoinGlass confirms the impact of options trading on Bitcoin’s price movements. The growth in open interest and volume indicates increased market activity as Bitcoin approached its all-time high.

Impact of Options Trading on Price Volatility

During periods of volatility, options trading plays an outsized role in shaping Bitcoin’s price movements. The unwinding of positions by options traders can lead to significant price fluctuations, especially in a less liquid environment.

All the data points to the increasing influence of options markets on Bitcoin’s volatility, highlighting their central role in price discovery and the amplification of price fluctuations during periods of decreased liquidity.

The post Options wield outsized influence on Bitcoin’s volatility appeared first on CryptoSlate.