The Resilience of Bitcoin as a Long-term Investment

Bitcoin has firmly established itself as a valuable asset over the long term, showing a notable trend of profitable returns for its investors.

Profitability Metrics

According to data from Newedge, Bitcoin has shown profitability on 5,134 out of 5,213 trading days since its inception. This remarkable figure represents an impressive 98.48% of all days, highlighting the consistent appreciation of BTC’s value over time.

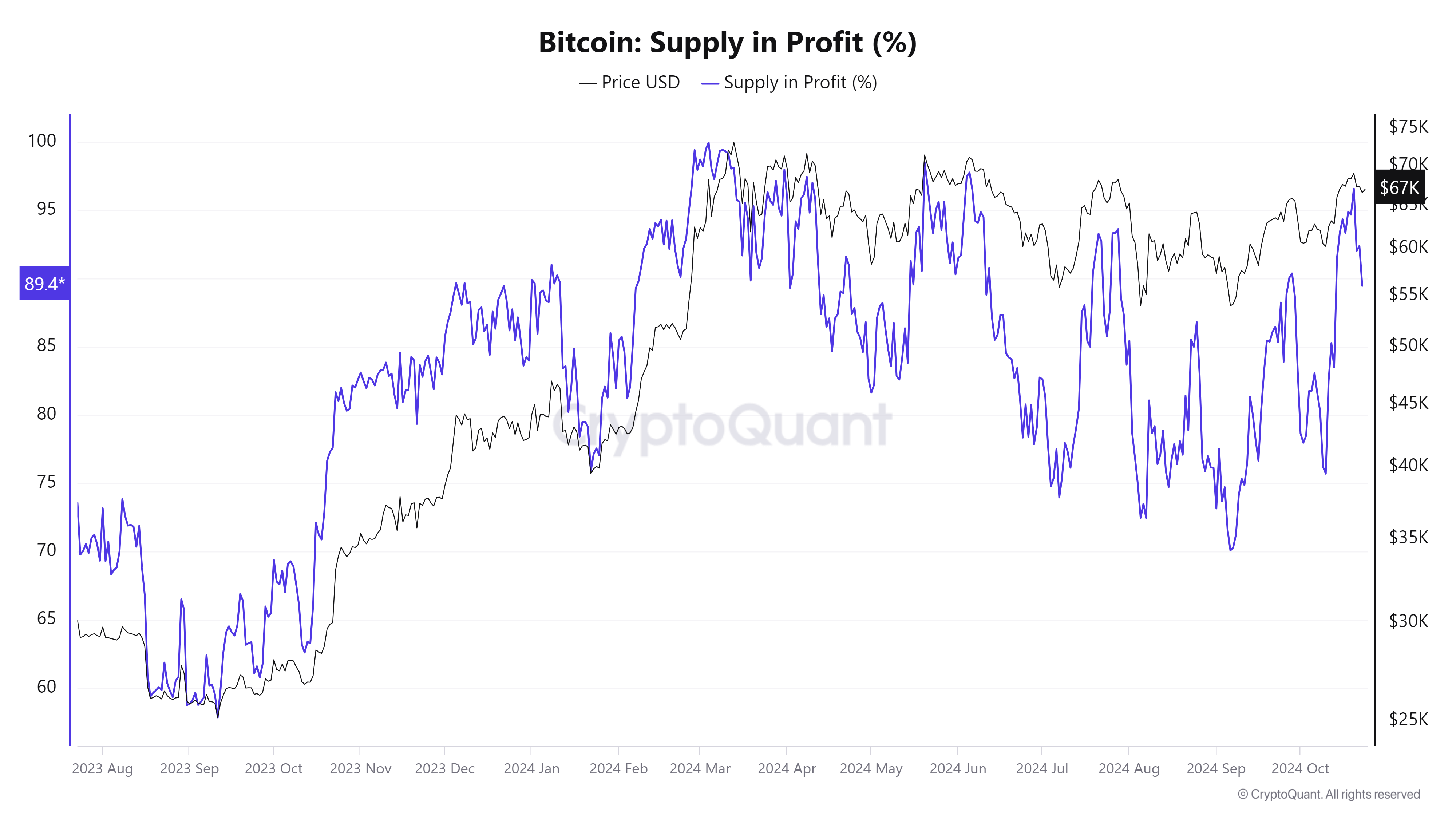

Current Supply and Profitability Trends

Further analysis by CryptoQuant reveals that approximately 90% of the current Bitcoin supply is in a state of profit. This trend is closely linked to the digital asset’s steady climb towards the $70,000 mark.

Investment Appeal of Bitcoin

The widespread profitability of Bitcoin reinforces its status as a resilient long-term investment choice. Despite facing occasional market fluctuations, Bitcoin has demonstrated a remarkable ability to rebound and achieve new peaks. Several factors contribute to this positive trend:

- Increasing institutional adoption, including Bitcoin ETFs

- Growing recognition of Bitcoin as a stable store of value

- Its role as a hedge against inflation