Tesla is holding steady with its Bitcoin investments despite some intriguing wallet activity that ignited speculation about a potential sell-off, based on insights from Arkham Intelligence, a blockchain analytics firm.

Clarifications from Arkham Intelligence

In a post made on October 23 on X (formerly Twitter), Arkham Intelligence provided clarity on the situation:

“We believe that the Tesla wallet movements that we reported on last week were wallet rotations with the Bitcoin still owned by Tesla.”

Details of the Wallet Transfers

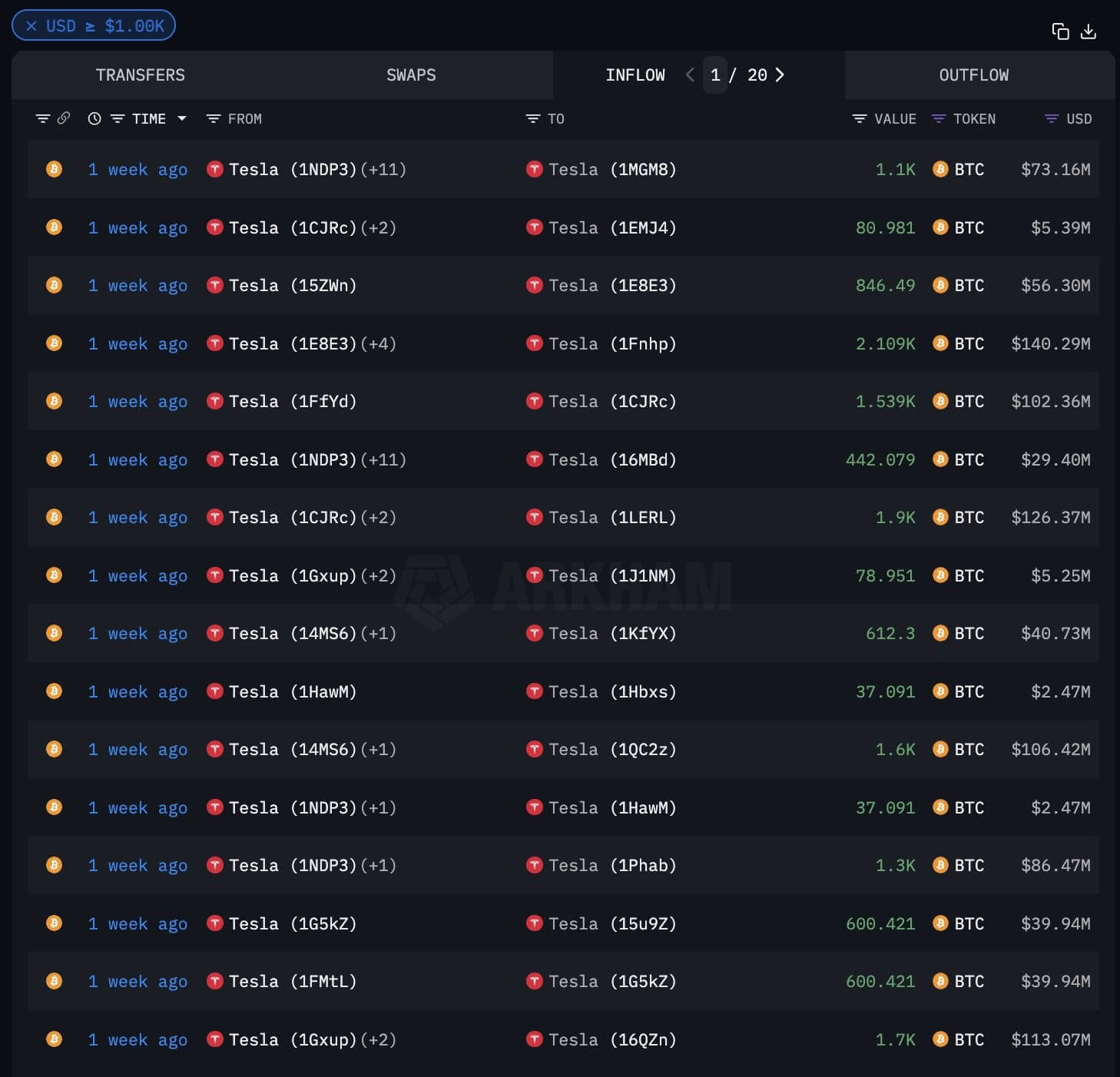

According to Arkham, the transfer involved reallocating Bitcoin to seven distinct wallets, with each wallet holding between 1,100 and 2,200 BTC. Test transactions were performed across all wallets, resulting in six holding round-numbered Bitcoin balances.

Value Breakdown of the Wallets

- Five wallets: valued over $100 million each.

- Specific values include:

- $142 million

- $128 million

- $121 million

- $114 million

- $107.8 million

- Two additional wallets: $87.6 million and $74.1 million, respectively.

Recent Transfers and Market Speculations

This recent activity follows Tesla’s surprising transfer of 11,509 BTC, valued at about $768 million, leading to speculation of a possible sale, given the company’s history of liquidating Bitcoin holdings.

Historically, Tesla sold 4,320 BTC in February 2021 shortly after investing $1.5 billion and subsequently offloaded 29,160 BTC in June 2022.

Possible Reasons Behind the Transfers

Despite the earlier sales, Tesla has largely held its Bitcoin assets since then. Arkham Intelligence raised the possibility that the recent wallet movement could be linked to securing a loan backed by Bitcoin:

“Some have speculated that this is movement to a custodian, for example, to secure a loan against the BTC.”

Looking Ahead

As of now, Tesla has not provided an official statement regarding the transfers. However, the fact that the Bitcoin remains intact across the new wallets has eased immediate worries about a market sell-off.

Industry analysts are now focusing on Tesla’s upcoming Q3 earnings report for deeper insights into the company’s recent moves.