Massive Inflows for iShares Bitcoin Trust ETF (IBIT)

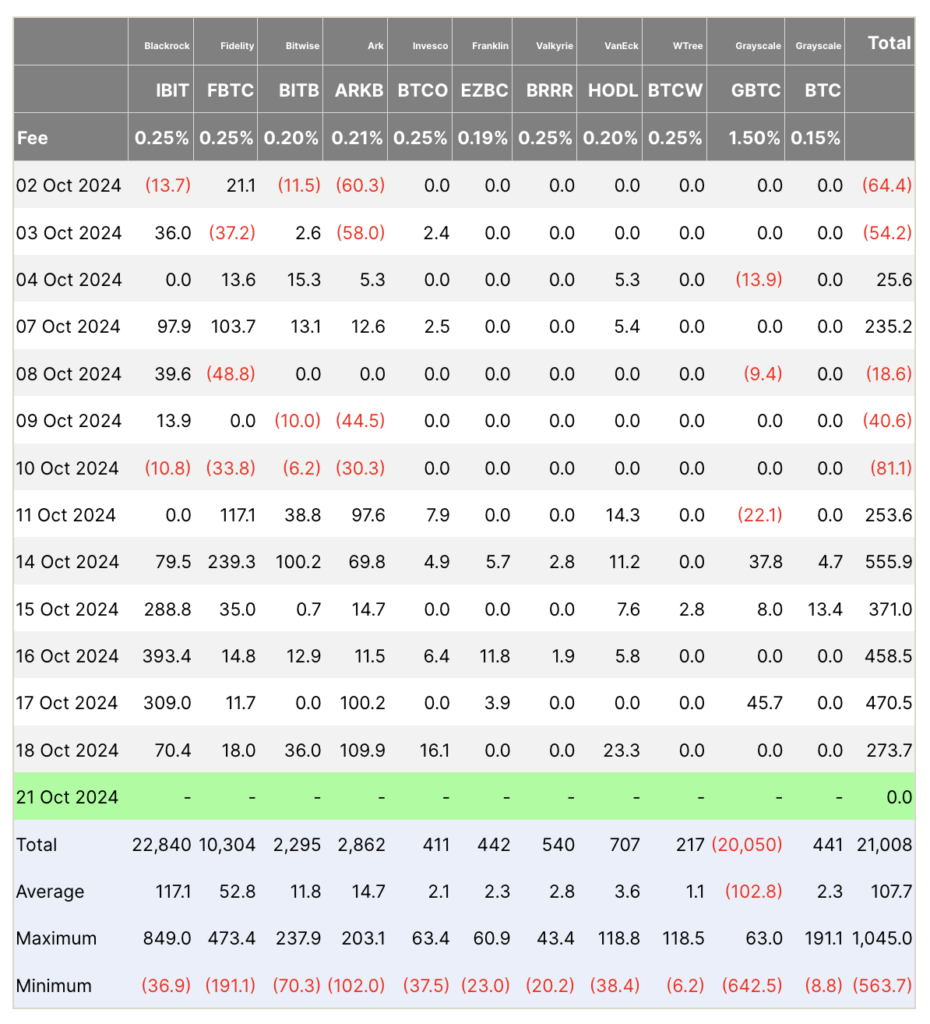

Last week, the iShares Bitcoin Trust ETF (IBIT) experienced an impressive surge, attracting over $1.1 billion in new cash inflows. This marks its best performance since March 2024, according to Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, who highlighted this significant trend.

IBIT’s Impressive Market Position

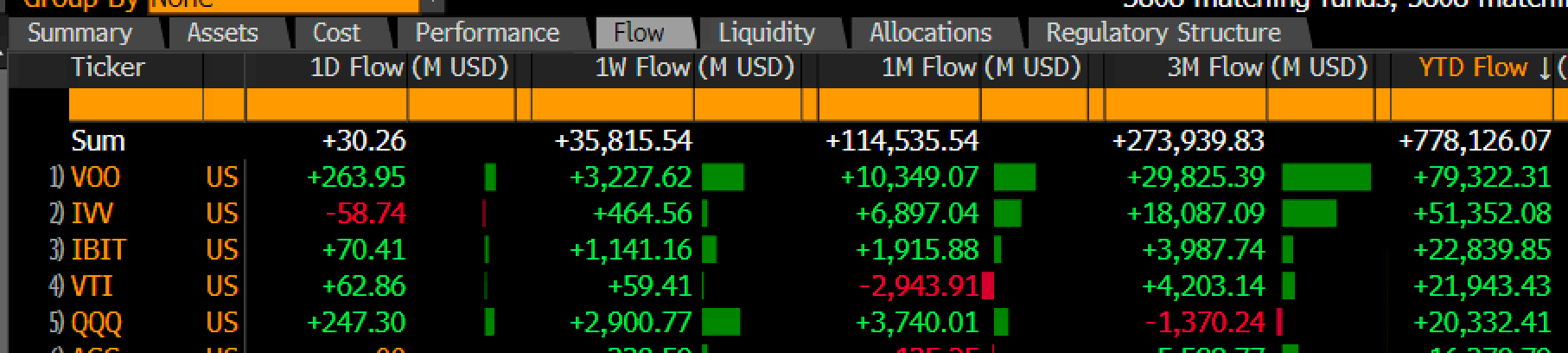

IBIT has now outperformed Vanguard’s Total Stock Market ETF (VTI) and claimed the third position for year-to-date inflows. This remarkable accomplishment is especially noteworthy as IBIT was only launched in January 2024, in contrast to more established ETFs that have been around for over twenty years and collectively manage assets exceeding $300 billion.

Signs of Investor Confidence in Bitcoin

Currently, IBIT manages total assets amounting to $22.8 billion, positioning it among the top 2% of all ETFs by size. This growth trajectory indicates a robust appetite among investors for Bitcoin exposure facilitated through traditional investment vehicles. As one of the pioneering spot Bitcoin ETFs approved in the United States, IBIT provides a user-friendly structure for those looking to enter the cryptocurrency market.

Factors Behind IBIT’s Success

- BlackRock’s Influence: As the world’s largest asset manager, BlackRock lends substantial credibility to IBIT.

- Increasing Acceptance: The growing mainstream acceptance of Bitcoin contributes to the fund’s popularity.

- Convenience of ETF Structure: The ETF format offers a familiar and convenient entry point for traditional investors.

The considerable inflows into IBIT reflect a significant shift wherein crypto-based ETFs are becoming increasingly prominent within the broader investment community.

Conclusion: A Sign of Evolving Investment Strategies

Insights from Balchunas underscore IBIT’s significant impact across the ETF landscape, highlighting a transformational phase where digital assets are progressively becoming vital components of diversified investment strategies.