Imbalance in Polymarket Order Book for the 2024 US Election

Recent data indicates a pronounced discrepancy within the Polymarket order book regarding the 2024 US Presidential Election.

Current Market Status

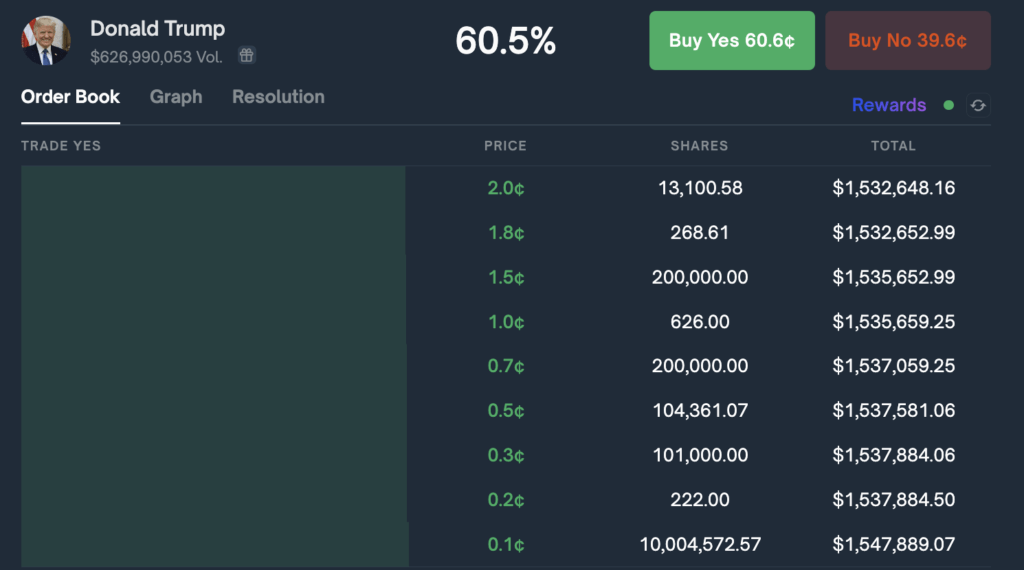

The betting market for a Donald Trump victory currently shows:

- Asks: $32 million

- Bids: $1.5 million

- Total Market Depth: $33.5 million

Such dynamics are typical in prediction markets, which often experience heightened sell-side pressure due to their time-sensitive nature.

Sell Orders Breakdown

In Trump’s case, a substantial portion of the $32 million in sell orders is concentrated:

- Sell Orders Above $0.99: $28 million

- Remaining Sell-side Orders: $4 million

Conversely, Kamala Harris’s market shows:

- Total Asks Above Current Price: $17 million

- Asks Above $0.99: $13 million

Market Depth Insights

A notable observation is the scanning lack of order depth both around and below the current market price, which sits at $0.60:

- Visible Market Depth Between $0.01 and $0.62: $2.5 million

- Orders in the Harris Market: $3.5 million within the same range

As a result, Trump holds $1.5 million in total bids while Harris trails with $1.4 million as per the latest updates.

Liquidity Analysis

Both Trump and Harris present low ask values up to $0.62, requiring minimal liquidity for a significant market shift, estimated at just over 1.4% of the current open interest (approximately $4 million).

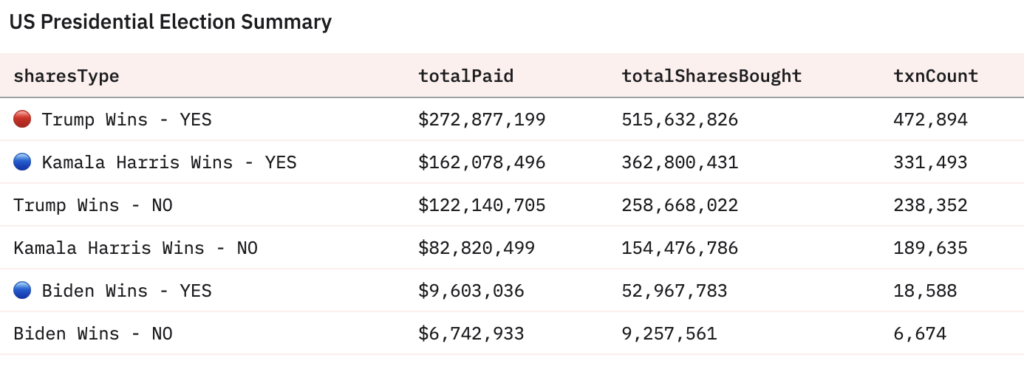

Dune Analytics reveals that Trump’s open interest alone is approximately $276 million, indicating that the visible market depth captures only a small fraction of total positions.

Discrepancies in Reported Data

There are notable discrepancies between the reported open interest figures and actual betting volumes, with Trump bets reportedly surpassing Polymarket’s stated total of $239 million.

Insight from Industry Observers

Experts in the sector have reported difficulties accessing accurate open interest data via Polymarket’s website. Hasu, a strategist at Flashbots, highlighted this challenge and questioned the site’s focus on trading volume over open interest metrics.

Significant Betting Activity

The data also show that the top four holders of Trump positions have collectively engaged in substantial bets, acquiring significant portions of the order book:

| Trader | Positions Value ($) | Profit/Loss ($) | Volume Traded ($) | Markets Traded | Joined |

|---|---|---|---|---|---|

| Michie | 3,980,981.12 | 341,179.18 | 8,450,962.77 | 0 | Oct 2024 |

| PrincessCaro | 6,978,910.68 | 813,711.08 | 23,473,481.78 | 14 | Sep 2024 |

| Theo4 | 7,280,451.39 | 137,384.50 | 15,206,599.73 | 8 | Oct 2024 |

| Fredi9999 | 16,723,955.99 | 1,556,542.18 | 74,097,607.44 | 45 | Jun 2024 |

| Total | 34,964,299.18 | 2,848,816.94 | 121,228,651.72 | 67 |

Market Movement Potential

The persistent buying behavior among these four traders has raised the theoretical possibility that an injection of approximately $4 million in buy orders could trigger a dramatic market impact due to the shallow order structure for Trump.

This strategic investment could potentially elevate Trump’s price from $0.60 to nearly $0.99, resulting in a remarkable 65% increase in his odds.

Remarkably, a similar order size in Harris’s market could yield comparable effects, underscoring the symmetric nature of the underlying order stacks.

Though this $4 million represents a mere 1.4% of the reported open interest for Trump, the existing order book dynamics suggest it could have a disproportionately high impact on market prices. That said, real-world influences from other traders may moderate the overall movement observed in market behavior.