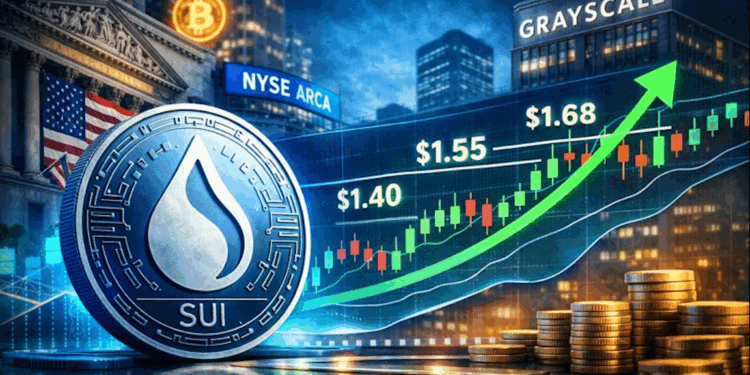

- Grayscale has submitted a proposal for an Exchange-Traded Fund (ETF) centered on SUI, thereby enhancing institutional engagement with the asset.

- SUI is currently priced at $1.41, encountering substantial resistance at the $1.55 threshold.

- Market analysts caution regarding a potential short-term downturn prior to the establishment of a stable price base.

The proposed ETF is set to trade under the ticker GSUI on the NYSE Arca and is uniquely structured to incorporate staking functionalities, allowing investors to derive yield while maintaining their holdings in the token.

Coinbase has been designated as the primary brokerage for the ETF, with administrative responsibilities being handled by the Bank of New York Mellon. Additionally, several firms, including Bitwise and Canary Capital, have also initiated filings for SUI-related financial products. These developments signify an uptick in institutional interest toward the Sui ecosystem.

The implications of these filings suggest that SUI may garner traction not solely among retail investors but also among professional investors seeking regulated exposure to this burgeoning asset class.

Sui Price Analysis

As of the current trading session, SUI is valued at $1.41, reflecting a decrease of 3.6% over the preceding week. The cryptocurrency has exhibited a constrained trading range within the last 24 hours, oscillating between $1.40 and $1.45.

Technical Indicators

Technical analysts have identified $1.55 as a pivotal resistance level for market participants to observe closely. A breach above this threshold could facilitate further appreciation towards subsequent targets at $1.60 and $1.68. Conversely, immediate support is situated around the $1.40 mark; a decisive breach below this level could precipitate a decline into the $1.20–$1.30 range.

The Relative Strength Index (RSI) suggests that SUI may currently be exhibiting oversold conditions in the short term, potentially indicating an opportunity for rebound.

Despite indications of potential upward movement, certain analysts advise caution, positing that any recent rebounds may lack strength when juxtaposed with larger cryptocurrencies such as Bitcoin and Ethereum. Speculation exists that SUI could revisit lower support levels near or slightly above the $1 threshold prior to establishing a more robust foundation.

The observed 7-day trading range of $1.38 to $1.54 illustrates inherent volatility but simultaneously indicates that buyers are actively defending critical price zones.

SUI Price Outlook

As institutional interest burgeons amidst heightened volatility in the broader cryptocurrency market, recent ETF filings from various firms underscore growing confidence in the long-term viability of SUI.

A historical performance analysis reveals that this altcoin has experienced substantial price fluctuations, with an all-time high recorded at $5.35 and a nadir at $0.3648. Notwithstanding these variances, SUI has achieved an impressive recovery of over 285% from its most recent low, signaling robust recovery potential.

The trading volume remains substantial, with more than $635 million transacted within the last 24 hours—a liquidity level that can bolster price movements as market participants react to ongoing ETF developments and prevailing technical patterns.

If bullish momentum continues unabated, it is conceivable that SUI may challenge the $1.55 resistance level in the near future. Conversely, failure to ascend beyond critical resistance thresholds could usher in a consolidation phase or minor market pullback.

The interplay of burgeoning institutional interest, ETF filings, and current technical configurations renders this a pivotal juncture for SUI. Market participants are expected to closely monitor both price dynamics and regulatory updates as they unfold.

As SUI navigates its established resistance and support levels in the coming weeks, its trajectory will be crucially determined by forthcoming market developments. Should bullish momentum materialize effectively, SUI may be poised for a renewed upward cycle toward the $1.55 mark.