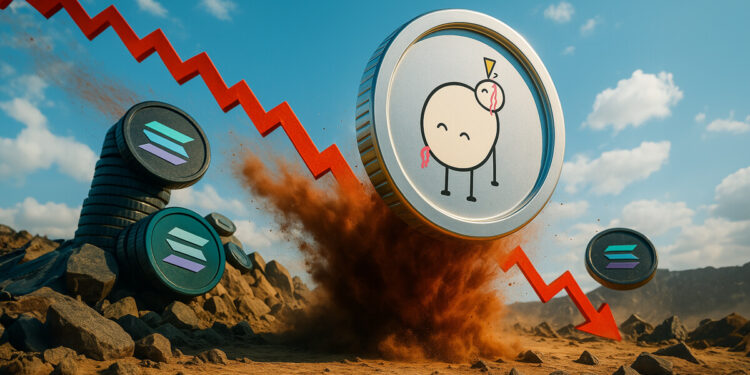

The contemporary landscape of the Solana memecoin economy is beset by a pronounced liquidity crisis and a significant contraction in trading volumes. However, amidst this sector-wide decline, one particular asset has managed to decouple from the overarching negative trend, presenting a unique case study for analysis.

According to data sourced from CryptoSlate, PIPPIN, an asset that originated from an artificial intelligence experiment in early 2024, has emerged as one of the most compelling performers within the cryptocurrency market over the past 30 days. The token has experienced an astonishing surge of 556%, standing in stark contrast to a market characterized by capital flight and investor fatigue.

This divergence is particularly noteworthy. The exuberance commonly referred to as “meme mania,” which characterized the initial phases of this year, has dissipated significantly across the Solana network, giving way to a stringent phase of market consolidation. In this context, PIPPIN’s trajectory presents an anomaly that warrants further investigation, bolstered by a confluence of factors including derivatives leverage, increasing open interest, and evidence suggesting a concerted effort to monopolize the token’s supply.

PIPPIN’s Derivative-Fueled Rally

To fully comprehend the exceptional nature of PIPPIN’s rally, it is essential to contextualize it within the broader environment of the Solana speculative market, which has undergone a severe contraction over the preceding six months.

Data from Blockworks Research indicates that meme assets now constitute less than 10% of daily trading volume within Solana-based decentralized exchanges (DEX), marking a dramatic decline from their previous dominance, which exceeded 70% at this time last year. This downturn can be attributed primarily to a significant erosion of trust within the market.

- A series of high-profile “rug pulls,” including the collapses of prominent tokens such as LIBRA and TRUMP, have severely undermined investor confidence and curtailed appetite for new token launches.

- The resultant fragmentation in liquidity has precipitated a decline in active traders, leading to thinner market depth and a cautious participant base hesitant to assume new positions.

In this milieu of capitulation and skepticism, PIPPIN has emerged as an unexpected attractor for the residual speculative liquidity that remains. Data from CoinGlass reveals that PIPPIN’s ascent is not solely attributable to spot buying; rather, it has been catalyzed by a substantial influx of leverage into its derivatives markets. As of December 1st, PIPPIN derivatives recorded over $3.19 billion in trading volume—an amount that eclipses many mid-cap utility tokens such as Hyperliquid’s HYPE and SUI.

Moreover, simultaneous with this spike in trading volume, open interest in PIPPIN derivatives doubled to $160 million. This surge indicates that traders are aggressively accumulating exposure to this asset—creating a self-reinforcing loop whereby capital concentrates around assets exhibiting positive momentum amid broader sector malaise. However, it is imperative to note that unlike previous market rallies characterized by widespread participation, this current movement appears narrow and precarious, predominantly sustained by futures market mechanics rather than genuine grassroots adoption.

The Great Supply Transfer

In addition to derivative dynamics, an equally critical aspect underpinning PIPPIN’s rally lies in on-chain phenomena indicative of a significant transfer of ownership. The token appears to be undergoing what can be termed a “changing of the guard,” wherein ownership is shifting away from early adopters towards what seems to be a syndicate managing substantial portions of the token’s supply.

This transition was notably underscored by the exit of a prominent early whale investor. On December 1st, blockchain analysis platform Lookonchain reported that a wallet identified as 2Gc2Xg liquidated its entire position of 24.8 million PIPPIN tokens—a stake originally acquired for approximately 450 SOL (around $90,000 at that time)—realizing an extraordinary return on investment valued at $3.74 million, equating to a remarkable gain of 4,066%.

This transaction exemplifies an organic trade executed by an early believer realizing life-changing profits; however, it raises pertinent questions regarding who absorbed such a substantial supply. On-chain forensic analysis conducted by Bubblemaps suggests that these buyers were not individual retail traders but rather part of a highly organized entity.

- Bubblemaps identified a cluster of 50 interconnected wallets that collectively purchased $19 million worth of PIPPIN tokens.

- These wallets demonstrated distinctly non-organic behaviors: they were funded through HTX exchange within tightly synchronized time frames and exhibited no prior on-chain activity.

- Furthermore, another analysis flagged 26 additional addresses that withdrew approximately 44% of PIPPIN’s total supply from Gate exchange within two months—valued at about $96 million—indicating deliberate strategic maneuvers aimed at extracting liquidity from centralized platforms and diminishing circulating supply.

The emergence of aggressive new speculators further complicates this landscape. For instance, one wallet identified as BxNU5a acquired 8.2 million PIPPIN tokens and currently holds unrealized gains exceeding $1.35 million. This accumulation suggests that the floating supply is rapidly being consolidated into fewer hands:

As organic holders exit their positions, they are increasingly replaced by entities appearing to coordinate their purchases with the intention of tightening market structure—a dynamic that renders price fluctuations significantly more sensitive to derivative flows previously mentioned.

What Does PIPPIN’s Rally Teach the Market?

This concentration in supply engenders a precarious valuation paradox for PIPPIN. On paper, it may present itself as an exemplary performer akin to its earlier valuations when creator Yohei Nakajima first promoted its AI-generated concept. Nonetheless, the fundamental landscape surrounding the token remains barren:

- No recent communications or updates have been issued by its creator.

- No new technological advancements or developments have surfaced to substantiate its resurgence towards a quarter-billion-dollar valuation.

Consequently, this rally appears more akin to a “ghost ship” momentum play—driven primarily by market structure rather than substantive product merit. For new whale investors and coordinated wallet clusters alike, potential exit strategies pose significant challenges:

- While wallet BxNU5a may exhibit substantial unrealized profits totaling $1.35 million, converting these gains into realized profits amidst thinning spot depth presents considerable risk.

- Should these coordinated wallets attempt to unwind their collective $96 million position simultaneously, liquidity mismatches could precipitate rapid price reversals.

Ultimately, PIPPIN serves as both an exemplar and reflection of current conditions within the cryptocurrency economy—an environment heavily influenced by leverage dynamics and shaped by sophisticated market actors capable of manipulating low-float assets. While outlier rallies may remain feasible under such circumstances, they increasingly become confined to the domain of whales and syndicates rather than accessible opportunities for everyday traders.