Disclosure: This is a paid article. Readers should conduct further research prior to taking any actions. Learn more ›

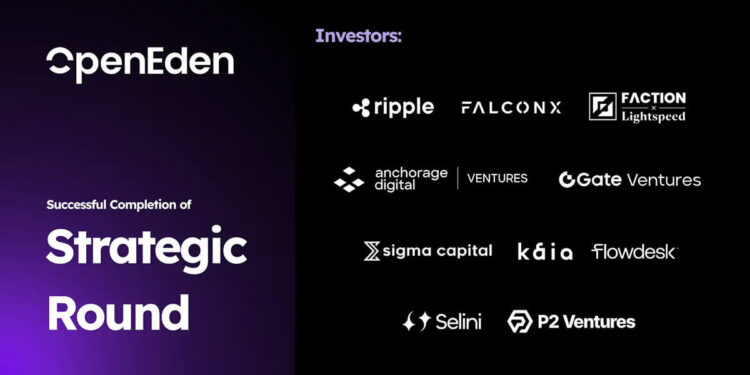

OpenEden has successfully concluded a strategic investment round, receiving backing from an array of prominent entities within the blockchain and institutional finance sectors. Notable participants include Ripple, Lightspeed Faction, Gate Ventures, FalconX, Anchorage Digital Ventures, Flowdesk, P2 Ventures, Selini Capital, Kaia Foundation, and Sigma Capital.

This funding round signifies a critical milestone for the RWA (Real-World Asset) tokenization platform as global institutional interest in compliant and yield-bearing on-chain assets continues to escalate.

A Strategic Push Toward Compliant, Composable Tokenized Finance

The recent investment follows OpenEden’s earlier fundraising efforts with Yzi Labs in 2024 and is earmarked for the enhancement of its end-to-end tokenization-as-a-service platform. This infrastructure is meticulously crafted to assist institutions, fintech companies, and developers in the issuance and management of regulated real-world asset products.

According to OpenEden’s official statements, the varied composition of participating investors—encompassing blockchain networks, venture capital firms, trading desks, and providers of institutional infrastructure—underscores a growing conviction surrounding the tokenization thesis, particularly within regulated frameworks.

“The growth of OpenEden mirrors the broader transformation we’re witnessing in the RWA sector,” stated Jeremy Ng, Founder and CEO of OpenEden. “As tokenization gains traction in adoption, institutions and protocols are seeking trusted, compliant infrastructure to transition traditional assets onto blockchain. This funding round amplifies our capacity to deliver regulated, market-ready products that adhere to both traditional and decentralized finance standards.”

RWA and Tokenized Treasuries Surge as OpenEden Builds Institutional Momentum

This announcement arrives at a pivotal juncture for the RWA landscape. The markets for tokenized U.S. Treasuries and broader RWA assets have experienced remarkable growth this year, with both categories more than doubling in value and achieving record levels of adoption and capital inflows.

OpenEden’s flagship TBILL Fund represents one of the earliest tokenized U.S. Treasury offerings and has emerged as a preferred vehicle for institutions desiring secure and fully transparent exposure to Treasury assets on-chain. Its peak assets under management have surged over tenfold within a span of less than two years.

Earlier this year, this fund reached an institutional milestone that is rarely observed within the digital asset sector: an ‘AA+f/S1+’ rating from S&P Global, in addition to its pre-existing ‘A’ credit rating from Moody’s.

The credibility of OpenEden was further solidified when The Bank of New York, one of the world’s most venerable financial institutions, was appointed as both custodian and investment manager for the underlying assets of the TBILL fund.

USDO Gains Traction as a Regulated Yield-Bearing Stablecoin

The institutional momentum surrounding the TBILL Fund has directly contributed to the burgeoning growth of USDO—OpenEden’s regulated yield-bearing stablecoin that is entirely backed by tokenized U.S. Treasuries. USDO has been integrated across major decentralized exchanges, liquidity venues, lending markets, and crypto-fiat gateways.

The wrapped variant of USDO, known as cUSDO, has garnered significant attention after being designated as the first yield-bearing digital asset approved as off-exchange collateral on Binance. This designation enables institutional users to accrue yield on their custodied assets while maintaining full access to margin trading capabilities.

New Tokenized Funds, Structured Products, and Global Stablecoin Expansion Ahead

With fresh strategic capital and an expanded network of global investors at its disposal, OpenEden is strategically positioned to expedite the next phase of its roadmap. The company is preparing to introduce a tokenized Short-Duration Global High-Yield Bond Fund in collaboration with a major international asset manager. In addition, a multi-strategy yield token that integrates traditional income sources with DeFi-native yield generation is also in development. Furthermore, OpenEden is innovating structured products designed to encapsulate familiar TradFi payoff profiles on-chain within compliant and programmable formats.

Beyond investment products, OpenEden aims to enhance USDO’s integration across both consumer-oriented and institutional payment networks on a global scale while simultaneously expanding its multi-currency stablecoin framework to accommodate new regional markets. In parallel efforts, OpenEden is constructing a cross-border stablecoin settlement network that aims to interconnect blockchain infrastructures with existing financial ecosystems.

Together, these initiatives align with the increasing demand for tokenization platforms capable of delivering institutional-grade safeguards without sacrificing the transparency and composability inherent in on-chain finance.

Industry Leaders Back OpenEden’s Regulatory-First Model

A number of participating investors have articulated that OpenEden’s methodical regulatory approach coupled with its institutional partnerships distinguishes it prominently within an increasingly competitive RWA market.

Markus Infanger, Senior Vice President at RippleX stated:

“As regulated financial assets transition onto blockchain platforms, institutional investors are actively seeking products that offer compliance, reliability, and the same controls they anticipate from traditional markets. OpenEden has demonstrated a disciplined operational framework; we are pleased to endorse their growth as assets such as tokenized T-bills emerge as viable pathways for institutions engaging with on-chain markets.”

Nathan McCauley, Co-Founder and CEO of Anchorage Digital elaborated:

“Real-world assets are attracting substantial institutional interest. OpenEden is constructing precisely the type of platform required by today’s market—broadening access to tokenized financial products while prioritizing trust and security. We are enthusiastic about supporting initiatives like those undertaken by OpenEden that propel forward the on-chain ecosystem and create avenues for increased institutional participation.”

Tokenized RWAs Move Toward Mainstream Finance

As adoption rates for RWAs ascend into a new era of mainstream financial engagement, OpenEden’s regulatory-first approach coupled with its commitment to institutional-grade standards positions it to play a pivotal role in sculpting the future landscape of tokenized financial markets.

By merging the oversight characteristic of traditional finance with the programmability afforded by blockchain technology, OpenEden is diligently constructing the necessary infrastructure aimed at facilitating the secure onboarding of trillions of real-world assets onto blockchain platforms at scale.