The Resilience of the Market Amid Bitcoin Price Volatility

Bitcoin’s recent pullback to $90,000 caused a stir in the market, but its subsequent recovery to above $96,000 on Jan. 14 offered some relief. However, key on-chain indicators suggest underlying stress in market health.

Net Unrealized Profit/Loss (NUPL) Indicates Market Sentiment

- NUPL dropped from 0.615 to 0.562 over the past week.

- A positive NUPL signifies unrealized profit and optimism among holders.

- Despite the decrease, NUPL remains in positive territory, indicating significant unrealized profits supporting the market.

- The drop in NUPL reflects a softening in sentiment rather than a fundamental shift.

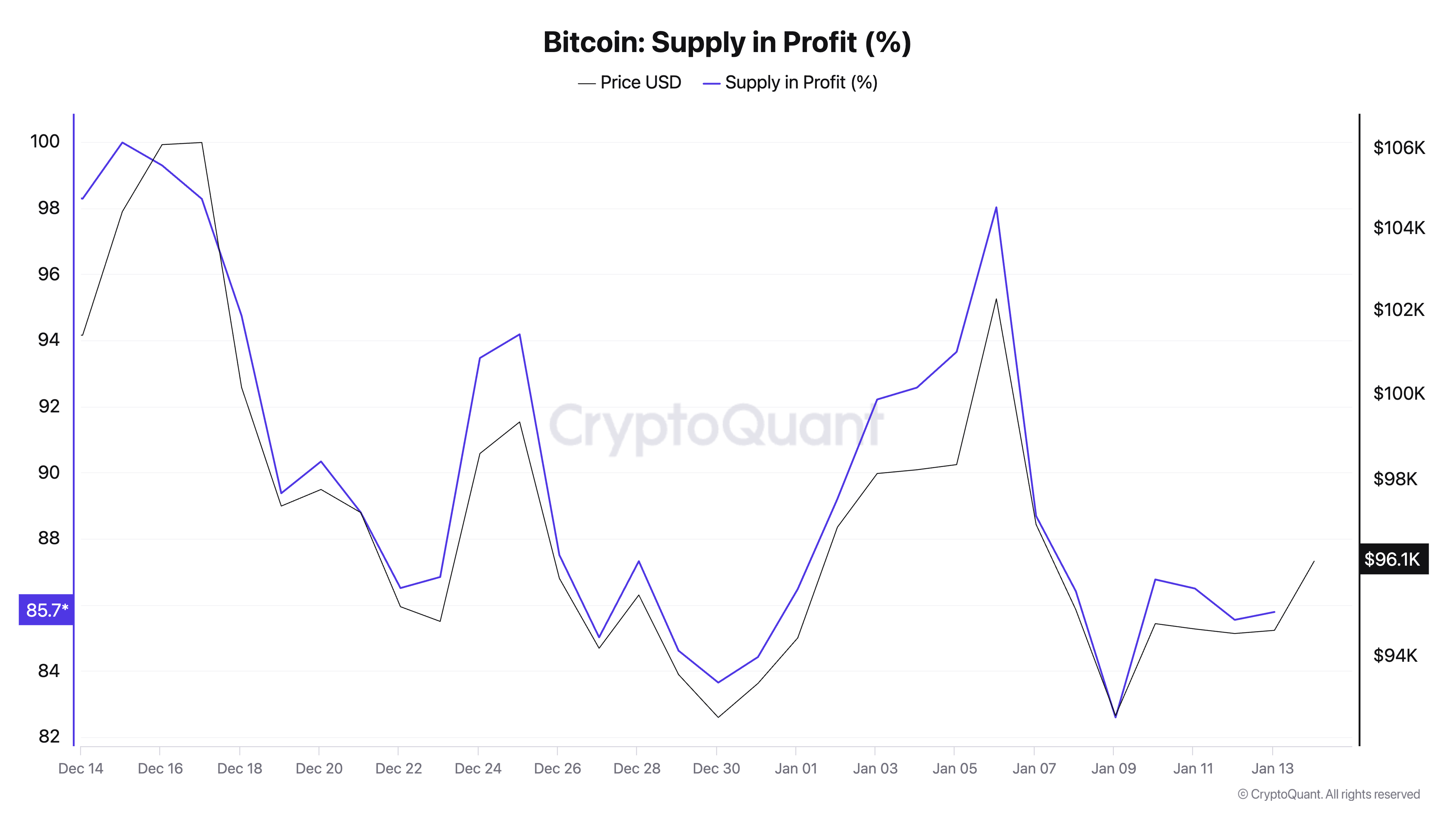

Percentage of Supply in Profit Declines

- The percentage of Bitcoin’s supply in profit dropped from 98.52% to 85.78% in the past week.

- This decline indicates a shift from unrealized profit to unrealized loss due to price fluctuations.

- Despite the drop, 85.78% of Bitcoin’s supply remains in profit as of Jan. 13.

- Most holders acquired Bitcoin at prices below the current market price, showing resilience in the market.

Market Stability Amid Price Volatility

Key metrics like NUPL and supply in profit provide insights into Bitcoin holders’ economic positioning and market health. Despite some unrealized losses, the data suggests robust support for Bitcoin’s price above $90,000, indicating a lack of prolonged distribution phase.

While these metrics offer a macro-level view of the market’s cost basis, they do not reflect actual trading activity. The resilience in the percentage of supply in profit highlights the strong base of optimistic holders supporting Bitcoin.

The market remains profitable despite Bitcoin’s recent price slump, showcasing the resilience of investors and underlying support for the cryptocurrency.