Bitcoin Liquidations Reach $464 Million in 24 Hours

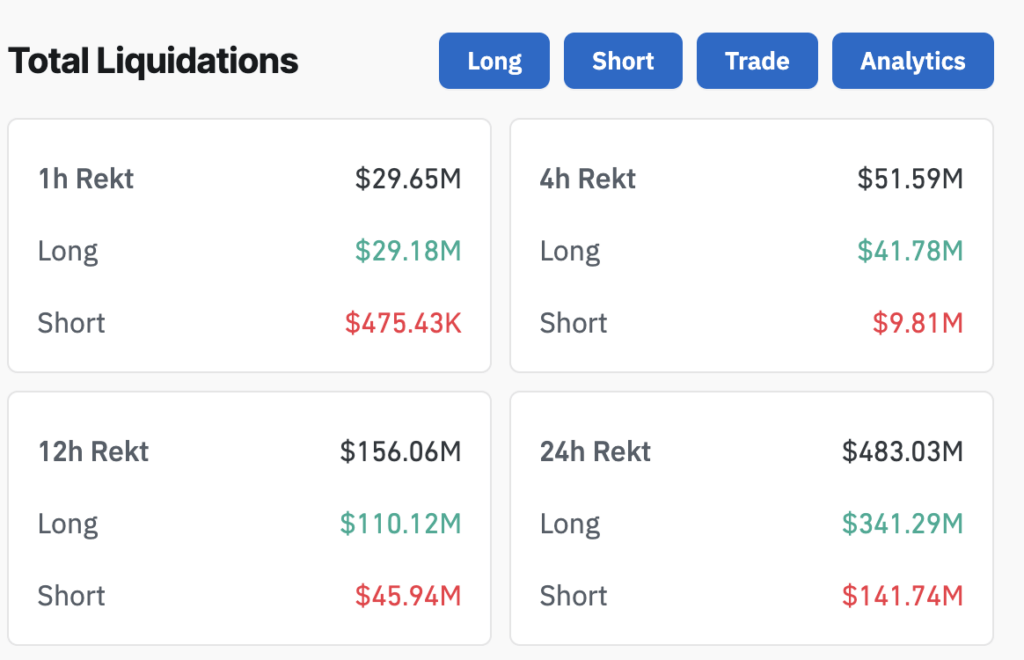

The past 24 hours have seen Bitcoin liquidations surpassing $464 million as the price dropped to $92,500, continuing the downward trend from yesterday’s $700 million liquidation event.

Long Positions Dominate Liquidations

- Long positions accounted for nearly 70% of the total liquidations, with $324 million cleared compared to $141 million in short positions.

- Despite potential signals of correlation with traditional equity markets, traders remained heavily bullish.

Exchange Activity Overview

- Binance led exchange activity with $190 million in liquidations, followed by OKX and Bybit contributing $144 million and $85 million, respectively.

- A single $15.30 million liquidation order on OKX’s BTC-USDT-SWAP underscored the severity of market movement.

Pattern of Cascading Liquidations

An analysis of data revealed a pattern of cascading liquidations, with $156 million in cleared positions over a 12-hour period, leading to an acceleration to the 24-hour total. This pattern typically indicates a snowball effect triggering further price declines and additional liquidations.

Bitcoin’s Correlation with US Equities

Market data suggests that recent price movements are linked to Bitcoin’s continued correlation with US equities, which experienced a significant downturn earlier in the week.