The Rise of the US Dollar in 2025

In recent times, the US dollar has seen a significant surge in value, reaching its highest levels in years. This surge has been primarily driven by the optimism surrounding Donald Trump’s return to the presidency.

Factors Contributing to the Dollar’s Strength

- Federal Reserve Rate Cuts: The dollar’s rally has been fueled by rate cuts implemented by the Federal Reserve over the past year.

- Economic Challenges in Other Countries: Challenges faced by other major economies, such as Japan, have also contributed to the dollar’s gains.

Impact on Risk Assets like Bitcoin

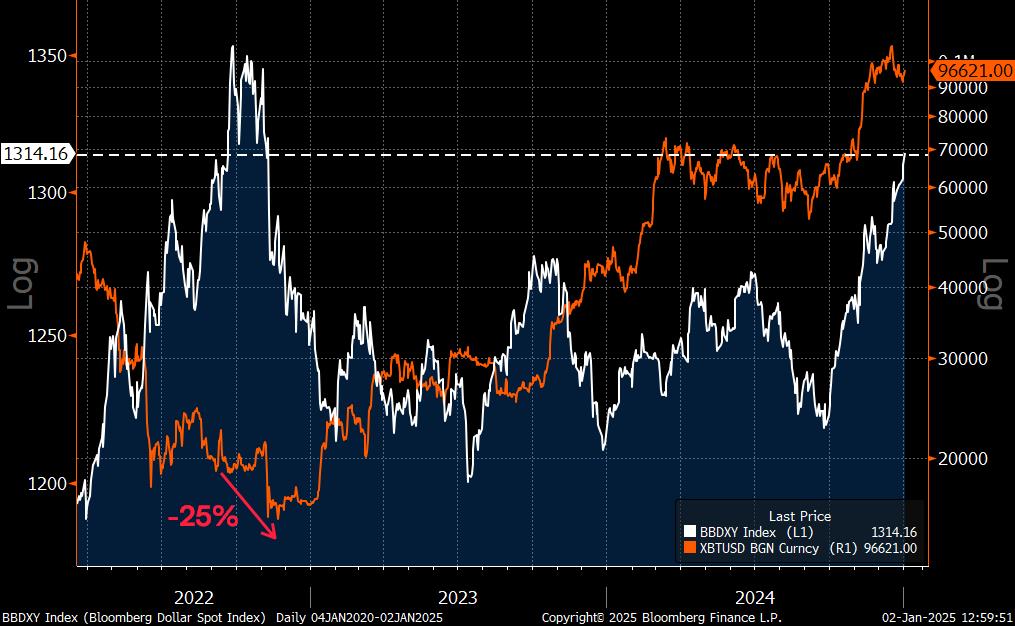

Historically, a strong dollar has posed challenges for risk assets like Bitcoin. However, the current scenario presents a different narrative. President Trump’s vocal support for Bitcoin has contributed to a sharp rise in its value following his re-election.

Analyst Insights

Bitcoin analyst Joe Consorti highlighted that Bitcoin is currently experiencing its longest stretch of dollar strength in over two years. He cautioned that historical trends suggest a potential 25% drop in Bitcoin’s value during a comparable dollar rally, with a current correction of 15%.

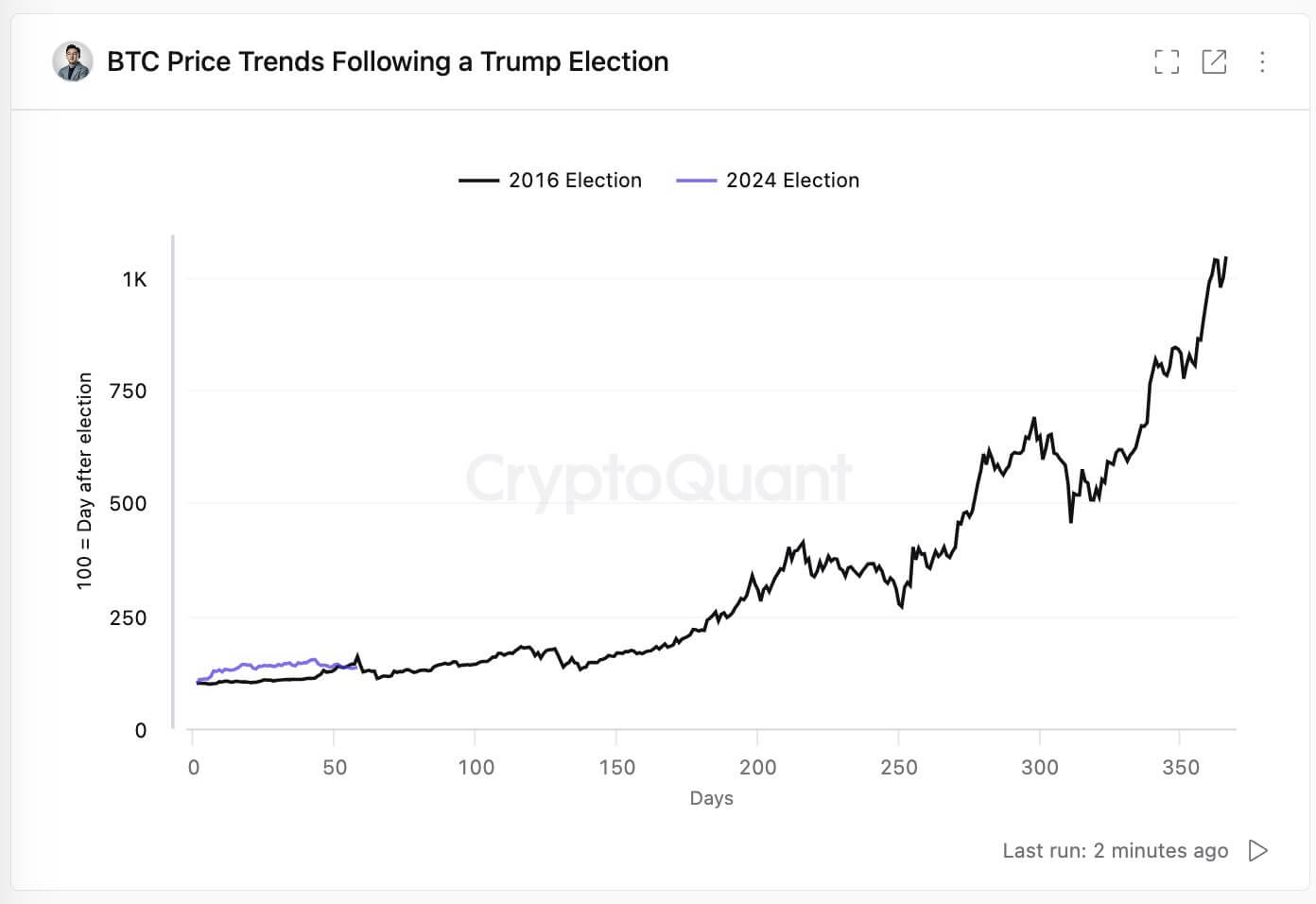

Ki Young Ju, CEO of CryptoQuant, remains optimistic about the future, suggesting that the Trump administration could lead to a pro-crypto era. This shift could reduce regulatory risks, increase institutional interest, and drive greater adoption of Bitcoin and other digital assets.