Weekly Crypto Price Analysis

Key Highlights:

- Prices of major coins traded sideways throughout the festive week, disappointing expectations for a “Santa rally.”

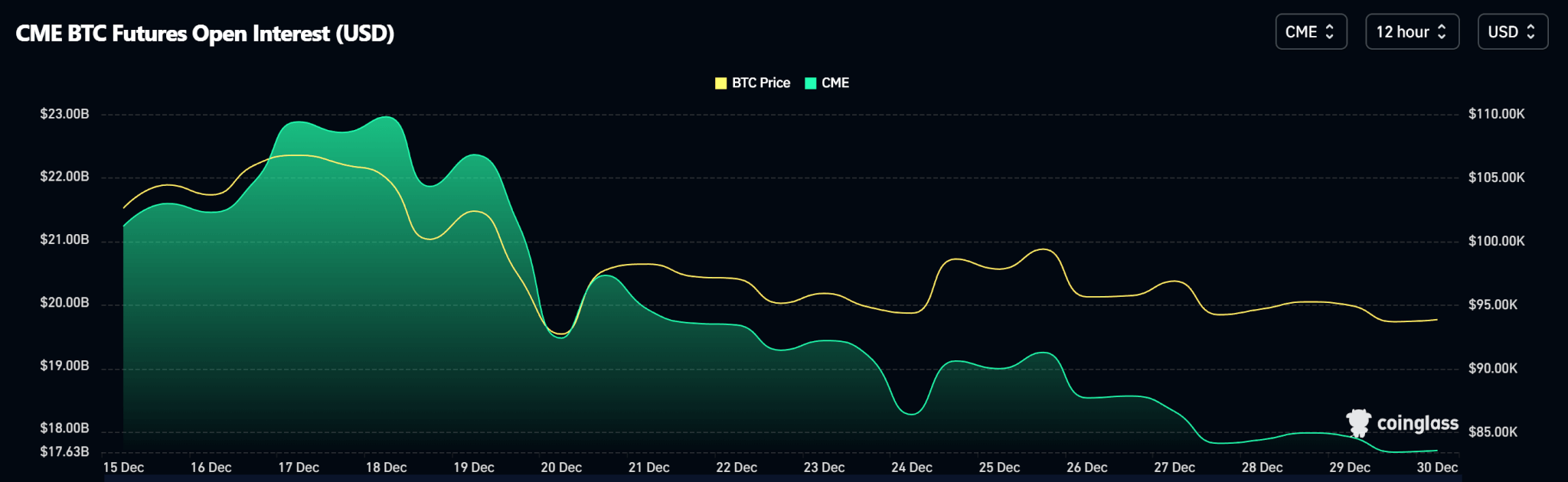

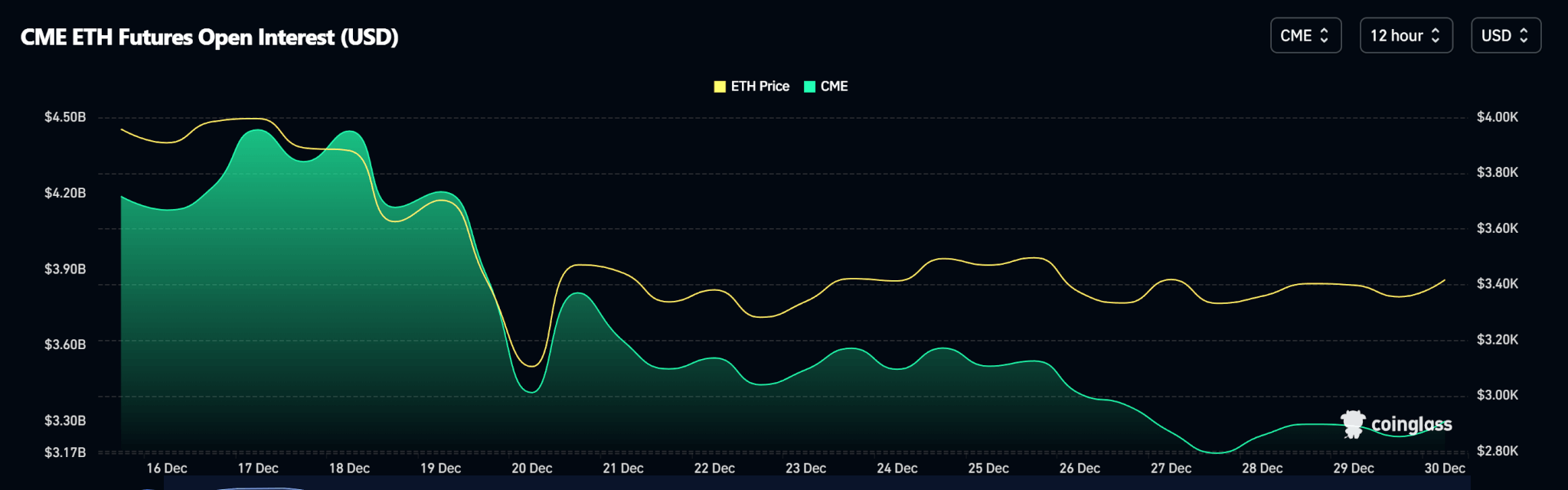

- Spot crypto ETFs showed mixed performance, while open interest continued to decline across major cryptos.

Bitcoin

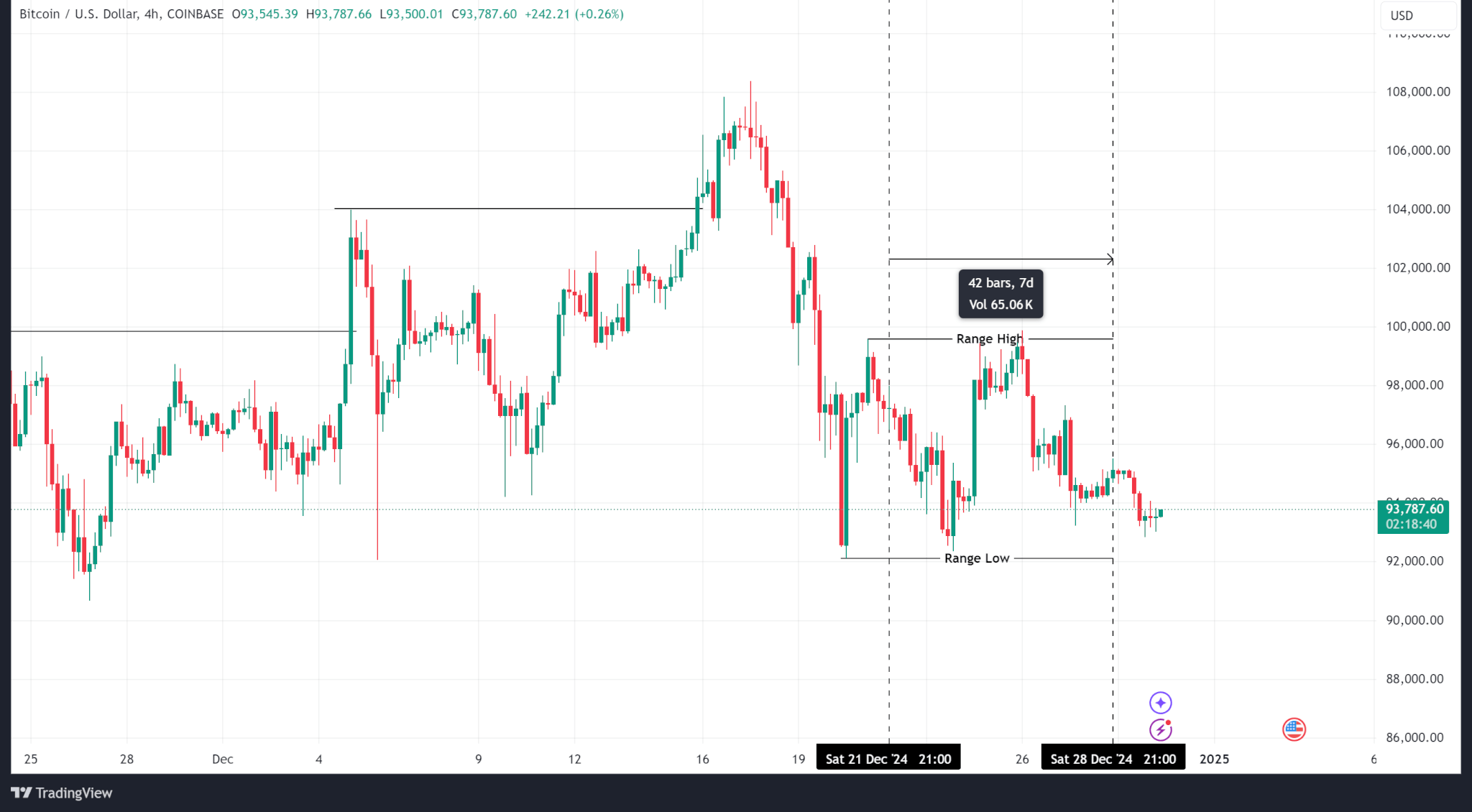

Bitcoin’s price experienced a decline from a weekly high of $99,859 to close at $93,449. However, the analysis of the intermediate time frame revealed a ranging movement that did not break the previous week’s high or low.

Bitcoin spot ETF flows saw four consecutive days of net outflows leading into Dec. 24, with net negative inflows of $89.70Mn for the week ending on Dec 27.

Current BTC price stands at $93,970.06.

Ethereum

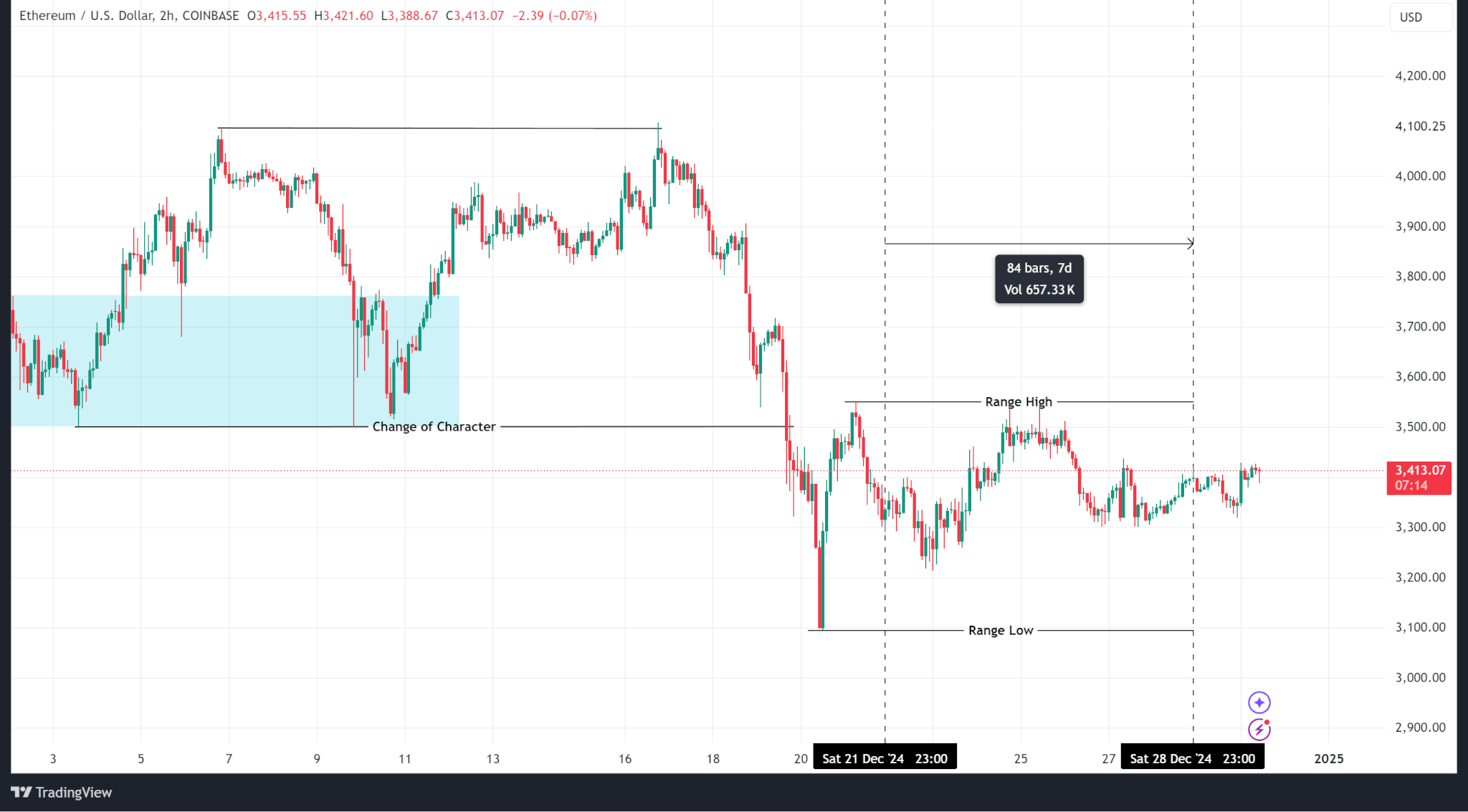

Ethereum’s price action remained range-bound throughout the week on lower volumes and open interest across official markets and major exchanges. Similar to Bitcoin, Ethereum’s price failed to break below the previous week’s low at $3,094.67 or above the range high at $3,550.80.

Spot ETH ETF flows recorded positive net weekly inflows of $349.3Mn after four days of positive inflows. Open interest data indicated decreasing levels as traders closed contracts towards the end of the year.

Current ETH price is $3,418.21.

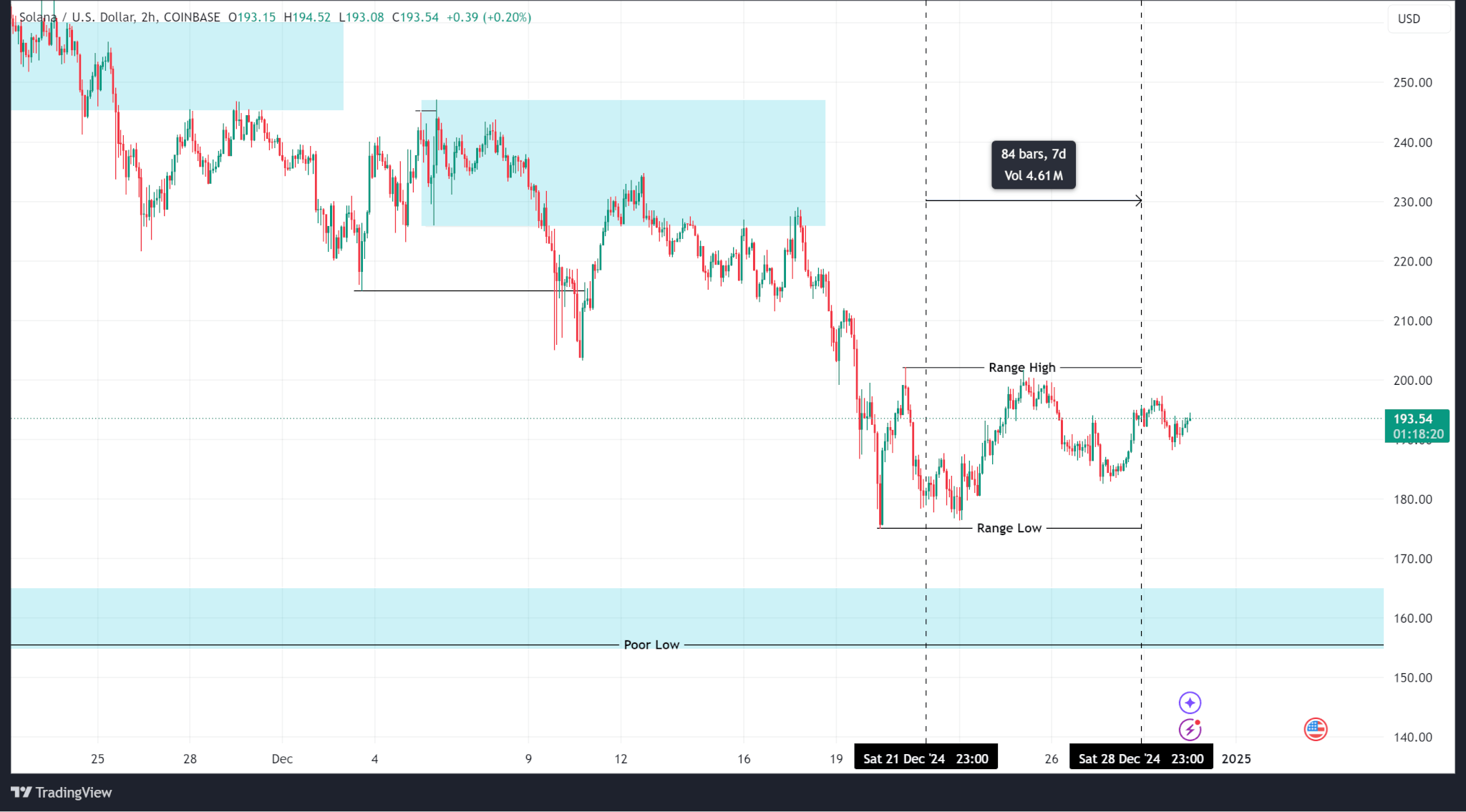

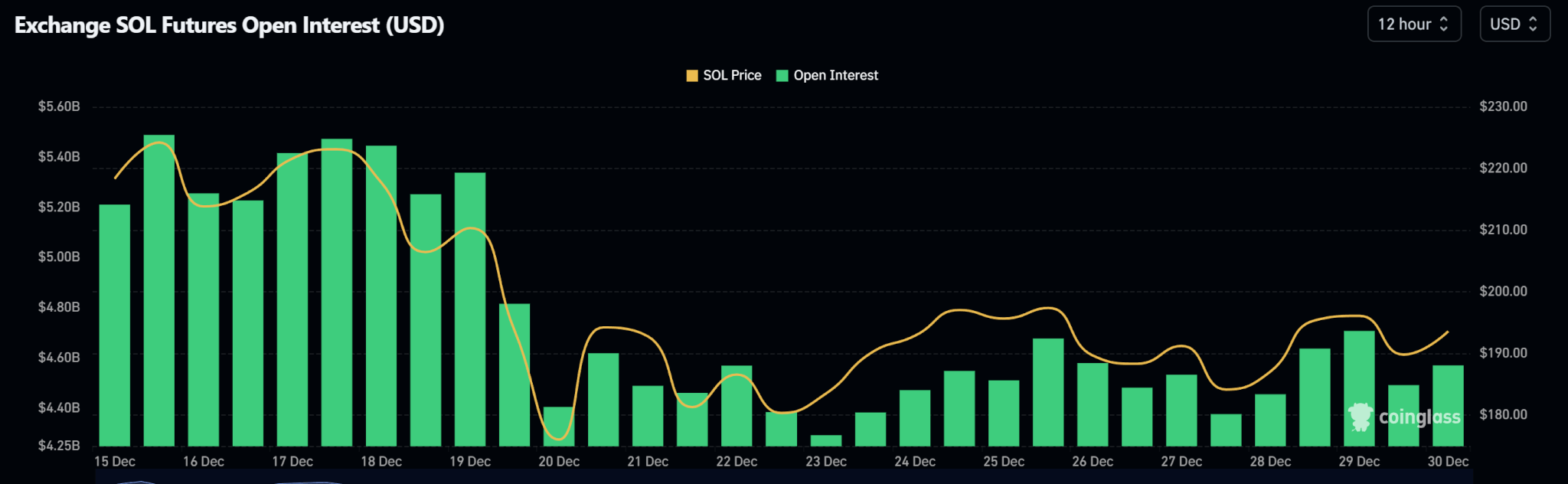

Solana

Solana’s price action fluctuated between a locally formed high at $202.00 and the previous week’s low at $175.10. Price tested the range high on Dec. 25 but failed to break above it, mainly influenced by retail traders.

Open interest data showed varying levels, generally lower compared to previous weeks.

Current SOL price stands at $193.07.

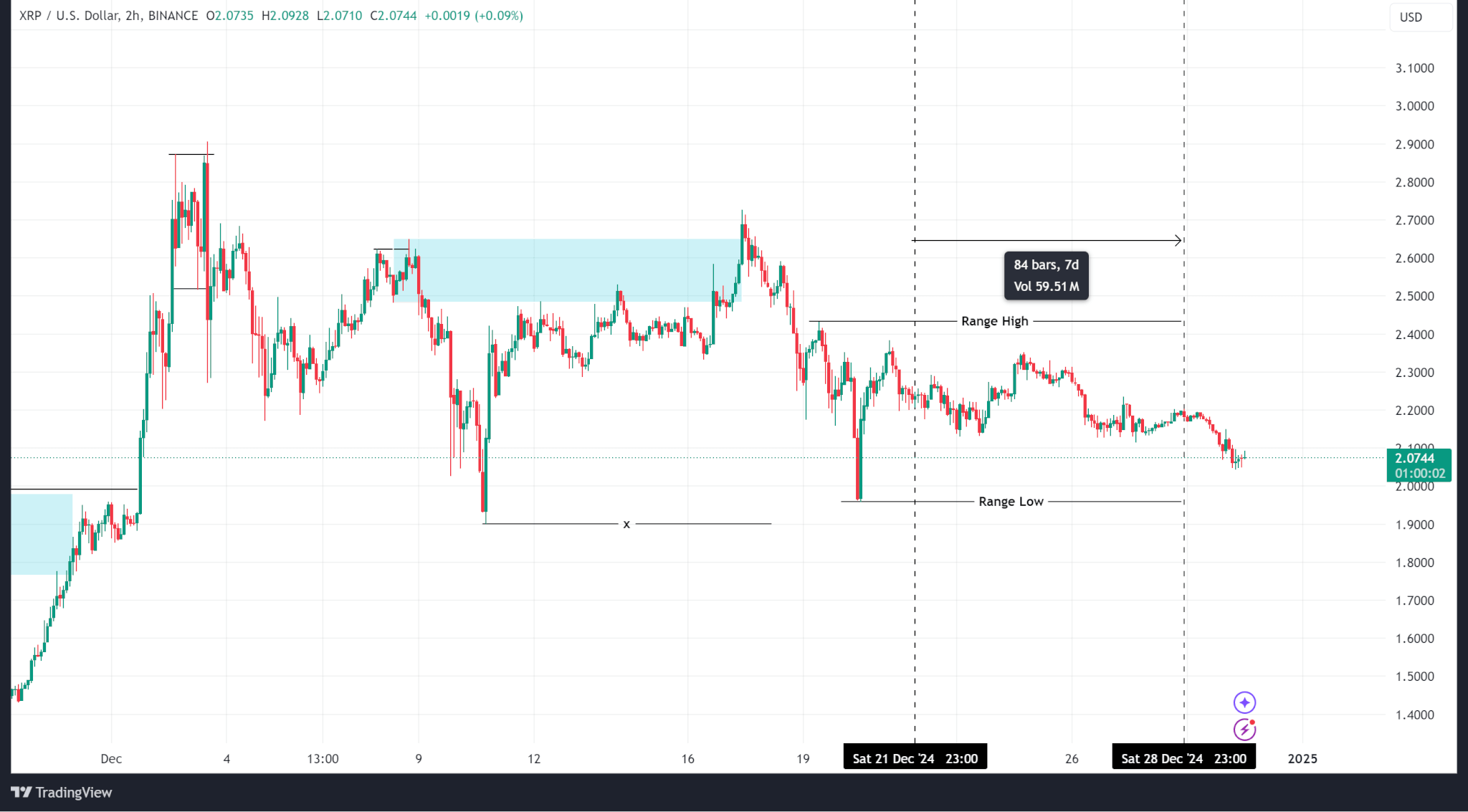

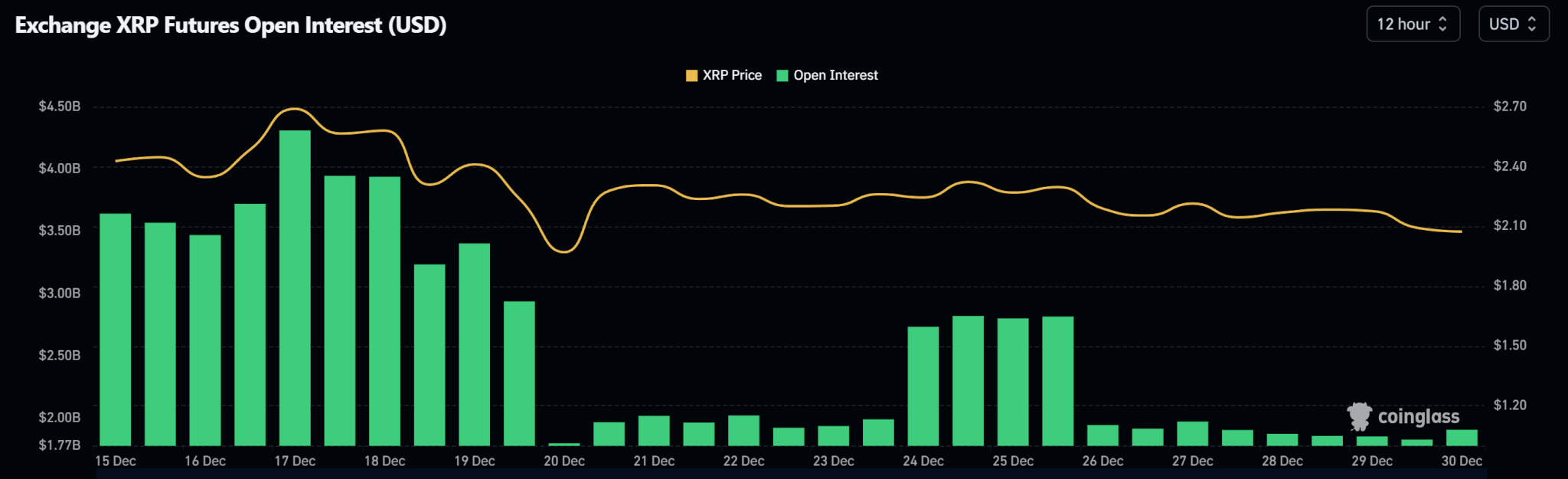

Ripple

Ripple’s price also traded within a range, reaching a high of $2.34 and a low of $2.11 for the week. However, the overall trend indicated a downward movement within this range.

Open interest data displayed sporadic levels influenced by pockets of retail traders.

Current XRP price is $2.06.