Bitcoin Supply Distribution Analysis

Bitcoin’s price has seen fluctuations recently, with a drop from its all-time high (ATH) leading to significant distribution among holders. Let’s take a closer look at the supply distribution dynamics:

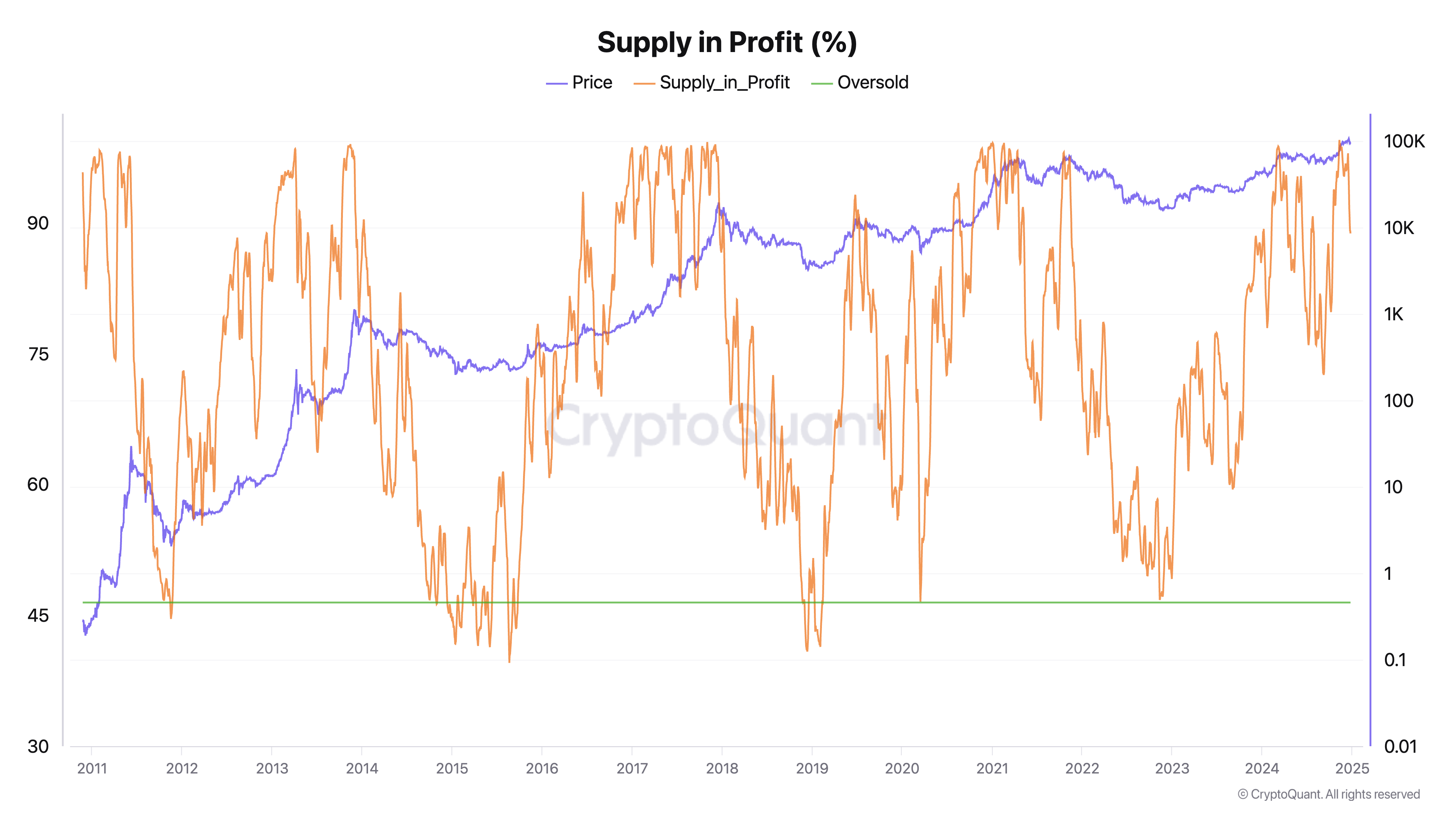

Supply in Profit

- After the US Presidential elections in November, BTC reached $89,000, with total supply in profit exceeding 99%.

- The subsequent increase to $106,800 by Dec. 17 led to a drop in supply in profit to 94.88%.

- By Christmas Eve, the supply in profit dropped to 88.89% as Bitcoin struggled to remain tied at $95,800.

Implications

Despite high prices, the decreasing percentage of supply in profit indicates significant distribution. This suggests new buying near peak prices, creating a group of underwater holders. Key points to consider:

- Approximately 11% of Bitcoin’s supply was bought or last moved at prices above current levels.

- These price levels may act as resistance in the near term as holders seek to break even.

Market Health

The rapid decline in profitable supply since mid-December follows a pattern of “smart money” distribution. While potential selling pressure may arise from holders nervous about price declines, high levels of supply in profit historically indicate strong market health and are essential for bull cycles.