Surge in Ethereum ETF Inflows Surpasses Bitcoin ETFs

In a surprising development within the cryptocurrency market, Ethereum ETFs are witnessing a surge in inflows, outpacing the outflows seen in Bitcoin ETFs.

Key Points:

- Ethereum ETFs are experiencing significant inflows, indicating a shift in investor sentiment.

- BlackRock’s iShares Ethereum Trust (ETHA) ETF led with a $89.51 million inflow on December 23, 2024.

- The trend may signal the beginning of an altcoin season in 2025.

Details of the Inflows

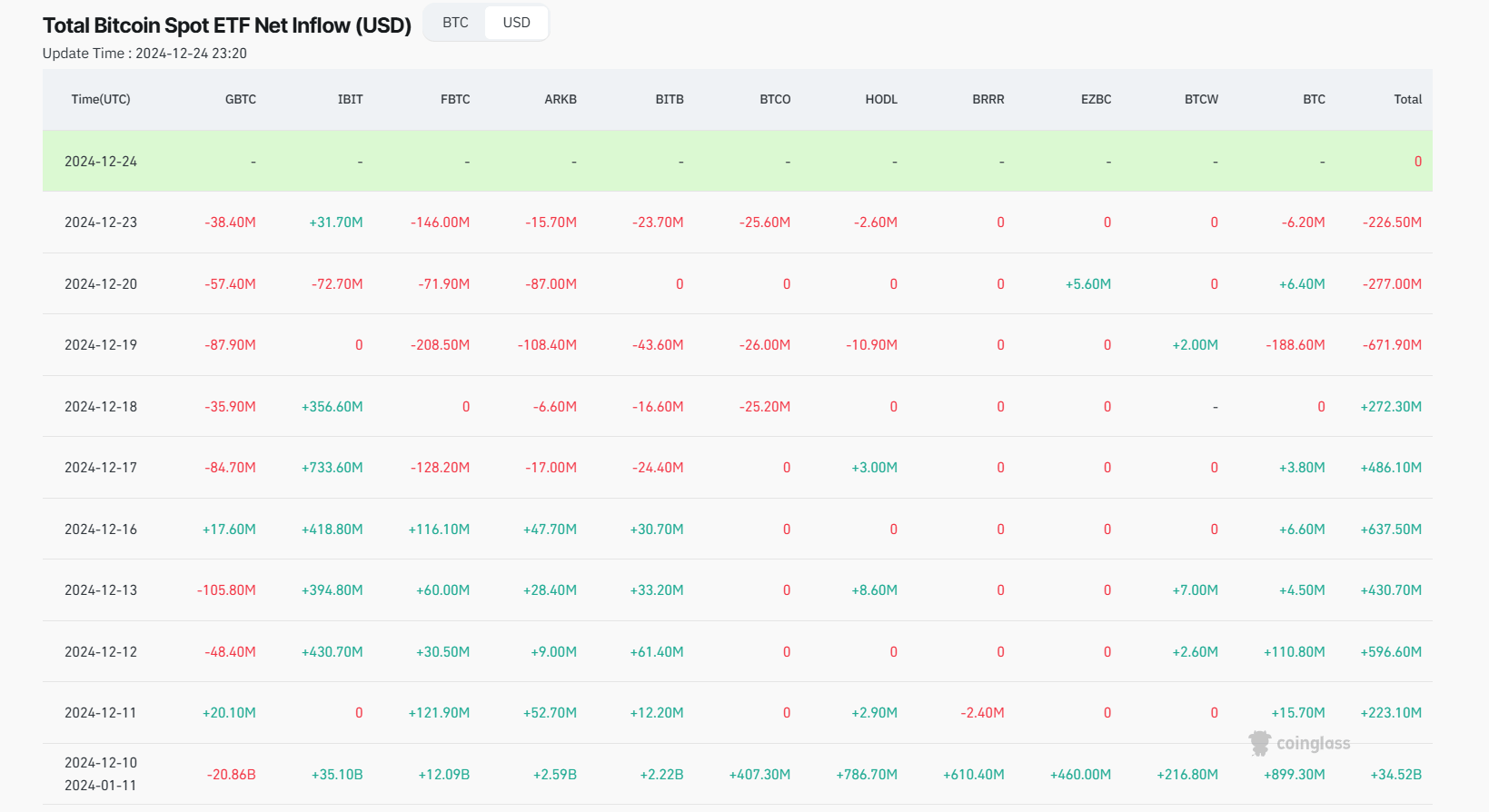

On December 23, 2024, Ethereum ETFs reported a net inflow of $130.8 million, with BlackRock’s iShares Ethereum Trust (ETHA) ETF securing $89.50 million and Fidelity’s Ethereum ETF (FETH) adding $46.40 million, as per Coinglass data. Meanwhile, Bitcoin ETFs saw outflows amounting to $226.50 million on the same day.

Consistent Trend

This surge in Ethereum ETF inflows has been consistent over recent weeks. For example, on December 12, Ethereum spot ETFs received a total net inflow of $273.70 million, maintaining a streak of 14 consecutive days with positive inflows. BlackRock’s ETHA ETF alone recorded a single-day net inflow of $202.30 million, while Grayscale’s Ethereum ETF (ETH) contributed $73.20 million.

The Rise of an Altcoin Season

Despite higher trading volumes, Bitcoin ETFs are witnessing outflows, indicating a potential shift in investor preference towards Ethereum. Analysts believe this could mark the beginning of an ‘altcoin season’, where investors diversify their portfolios beyond Bitcoin, with Ethereum leading the way.

Reasons for the Shift:

- Ethereum’s expanding ecosystem in DeFi and NFTs is attracting investors seeking growth opportunities.

- The regulatory landscape favors Ethereum’s diverse use cases over Bitcoin’s store of value narrative.

These developments raise speculation about the future of crypto investments. While Bitcoin has traditionally been the market leader, Ethereum’s recent performance in ETFs suggests a potential redistribution of investor interest, possibly leading to more balanced growth across various cryptocurrencies in 2025.