Bitcoin and Ethereum ETF Market Performance

US spot Bitcoin and Ethereum ETFs are experiencing different market performance, reflecting varying levels of investor interest in the top digital assets.

Bitcoin ETF Outflows

- Bitcoin ETFs recorded three consecutive days of outflows, totaling $226.5 million as investors adjusted portfolios.

- Fidelity’s FBTC led the declines with a loss of $146 million.

- Grayscale’s Bitcoin Trust followed with $38.4 million in outflows.

- Invesco’s BTCO saw $25.7 million in withdrawals.

- Bitwise’s BITB and ARK Invest & 21Shares’ ARKB reported combined outflows of $39.6 million.

However, BlackRock’s IBIT ETF stood out with $31.6 million in inflows amid the downward trend.

Bitcoin ETFs have accumulated $35.83 billion in inflows since inception, holding 5.7% of Bitcoin’s total supply valued at $105.08 billion.

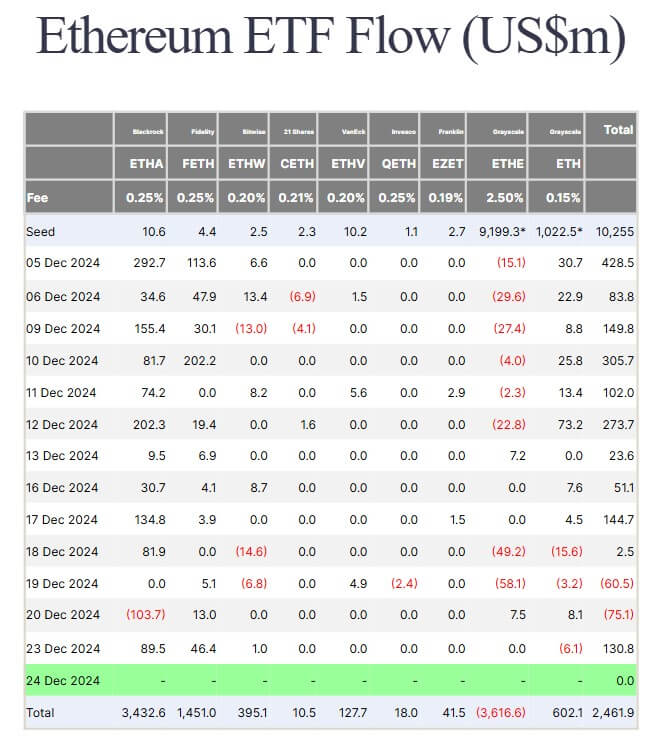

Ethereum ETFs Performance

Ethereum ETFs demonstrated a more positive outlook, securing $130.8 million in inflows.

- BlackRock’s ETHA attracted the most inflows at $89.5 million.

- Fidelity’s FETH fund added $46.4 million in inflows.

- Bitwise’s ETHW recorded modest gains of approximately $1 million.

Most Ethereum ETFs experienced minimal movement, except for Grayscale’s Ethereum Mini Trust, which saw a $6.1 million outflow.

Collectively, Ethereum ETFs have accumulated over $2.46 billion in inflows since their launch.