Bitcoin faced a significant price drop post the US Federal Reserve’s rate cut, but industry experts like Bitwise CIO Matt Hougan remain positive about the digital asset’s long-term future.

Impact of Federal Reserve’s Rate Cut

On Dec. 18, the Federal Reserve announced a 25-basis-point rate cut, revising its 2024 outlook to two cuts from the previously expected four.

Chair Jerome Powell’s remarks on Bitcoin’s regulatory status in response to inquiries about President-elect Donald Trump’s strategic reserve plans also contributed to market reactions.

Market Reactions

- Bitcoin’s price dropped to $98,839 then stabilized at $101,586.

- Ethereum, XRP, and Solana also experienced losses of around 5%, 5.5%, and 3% respectively.

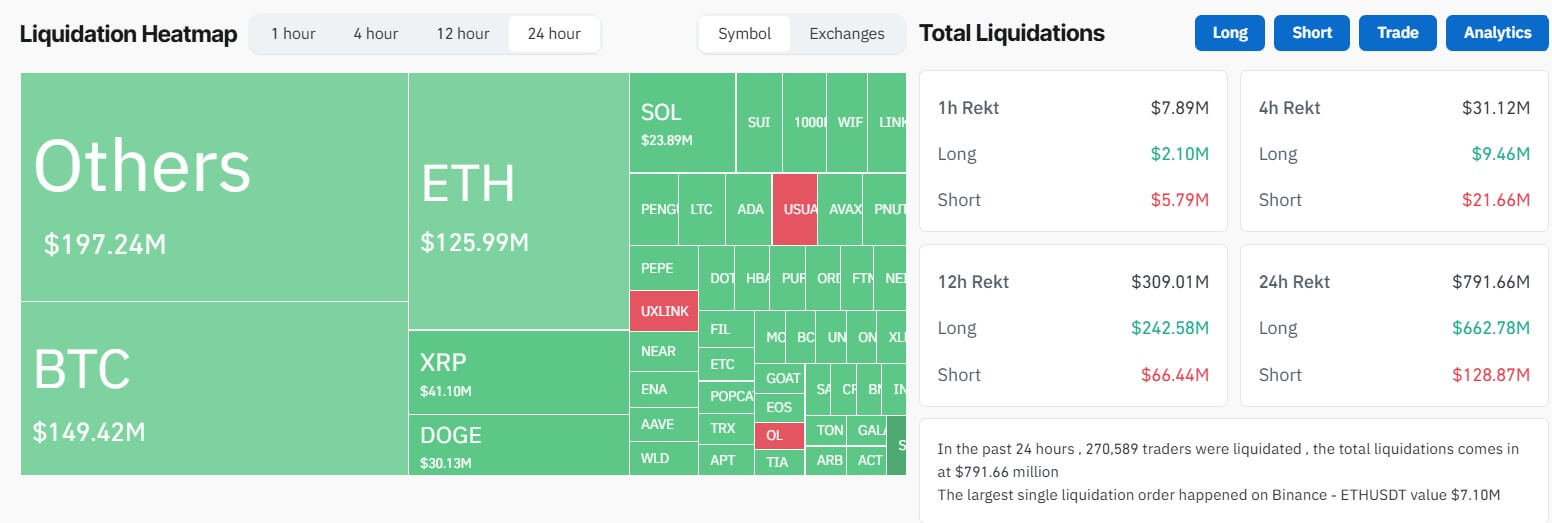

- Approximately $800 million in liquidation occurred, affecting over 270,000 traders.

- Traders speculating on price increases faced $662 million in losses within 24 hours.

Bitcoin’s Resilience

Despite the downturn, Hougan emphasized Bitcoin’s strong fundamentals driven by institutional adoption, favorable policy shifts, and increased Bitcoin acquisitions.

He also pointed out blockchain advancements and rising ETF flows as key market drivers.

Market Outlook

- Bitcoin’s technical indicators, with the 10-day EMA ($102,000) above the 20-day EMA ($99,000), signal bullish momentum.

- Hougan believes the current dip is temporary, stating it as a short-term fluctuation amid an ongoing bull market.

- Predictions indicate Bitcoin’s continued upward trajectory due to adoption trends and crypto tech advancements.

“Crypto’s in a multi-year bull market. 50bps of projected rate cuts won’t change that.”

Mentioned in this article