Transforming Microsoft with Bitcoin: A Bold Proposal by Michael Saylor

MicroStrategy executive chairman Michael Saylor recently presented a compelling case to Microsoft, urging the tech giant to incorporate Bitcoin into its strategy. Saylor emphasized that Bitcoin is not just a trend but a crucial component of the future technological landscape.

Key Points from Saylor’s Presentation:

- Saylor highlighted Bitcoin’s impressive performance, outpacing Microsoft’s stock returns by tenfold annually.

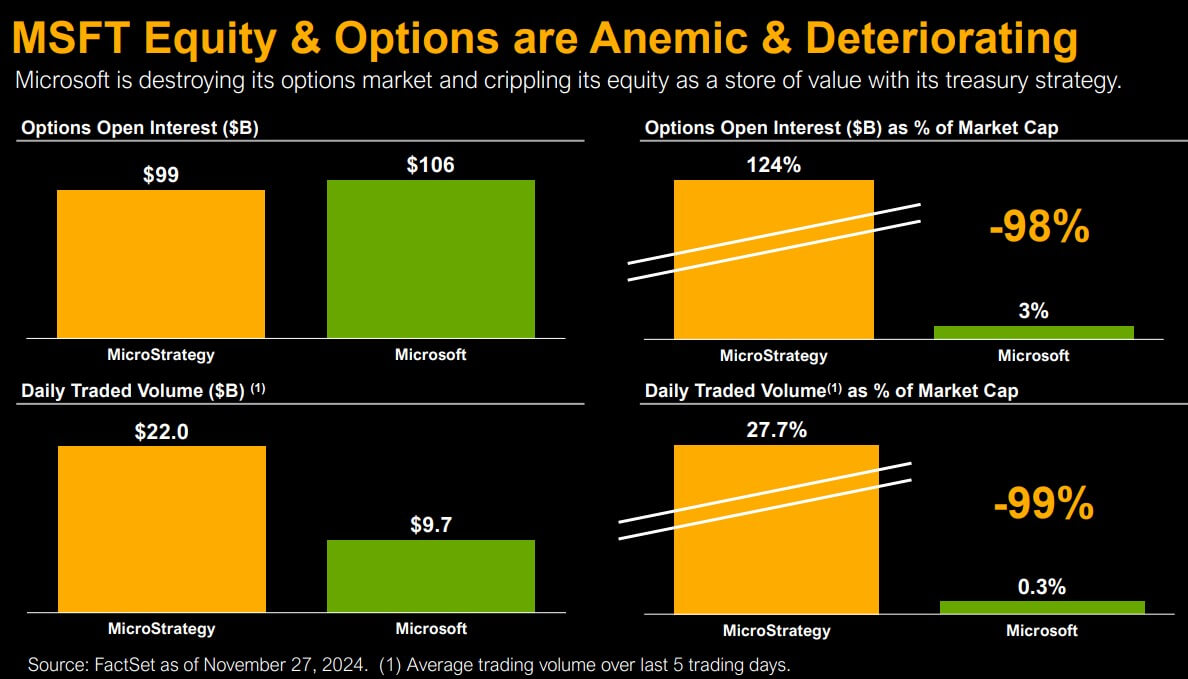

- He proposed redirecting resources from stock buybacks to Bitcoin investments for greater value generation.

- Saylor warned that failing to embrace Bitcoin could leave Microsoft lagging behind competitors in the evolving market.

The Roadmap for Bitcoin Ecosystem Transformation:

- Saylor envisions widespread Wall Street adoption of Bitcoin ETFs and favorable accounting rules by 2025.

- He emphasizes the need for pro-crypto leadership in Congress and a shift in regulatory attitudes towards Bitcoin adoption.

“Embrace the future. Invest in Bitcoin to accelerate growth and minimize risk,” Saylor stated.

Potential $5 Trillion Boost for Microsoft:

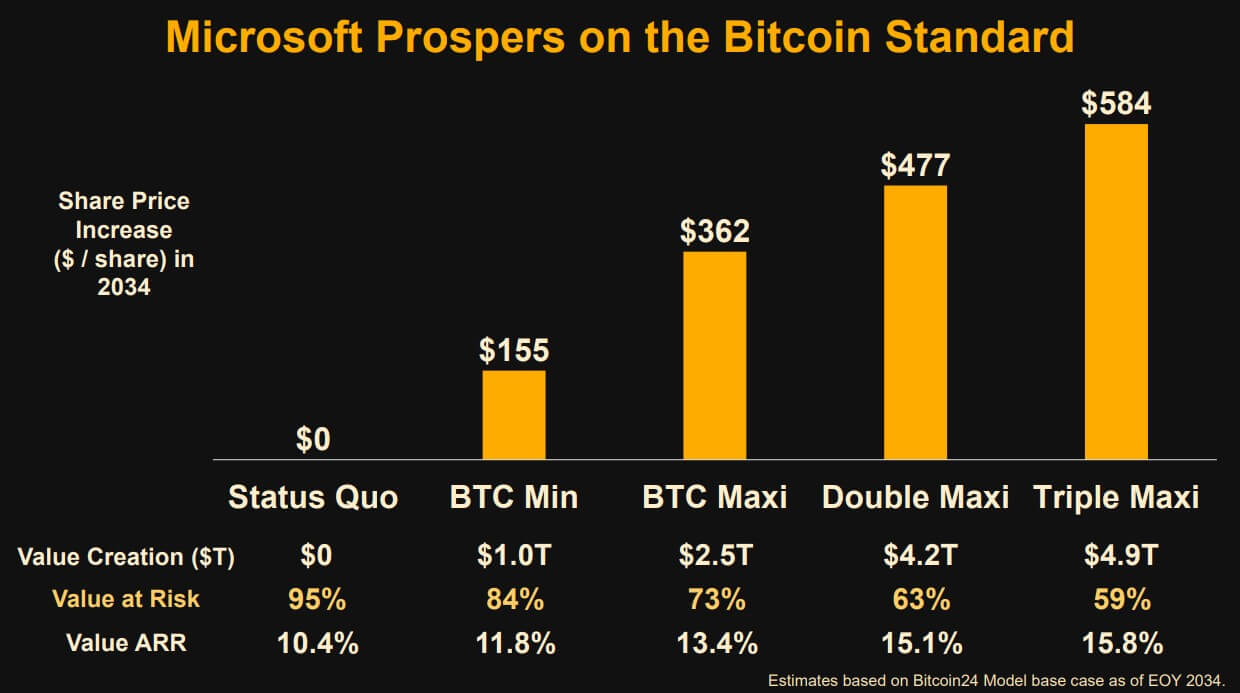

Saylor projected that implementing a robust Bitcoin strategy could add $5 trillion to Microsoft’s market cap over the next decade. By converting cash flows and buybacks into Bitcoin, the company could potentially see a significant increase in stock value.

Saylor’s proposal includes investing $100 billion annually in Bitcoin, emphasizing its security and growth potential over traditional assets like stocks and bonds.

In Conclusion:

Michael Saylor’s bold proposal to Microsoft highlights the transformative power of Bitcoin in shaping the future of technology and finance. Embracing this digital asset could not only drive growth but also position Microsoft as a leader in the evolving market landscape.