The Rise of Spot Bitcoin ETFs: Crossing $100 Billion in Net Assets

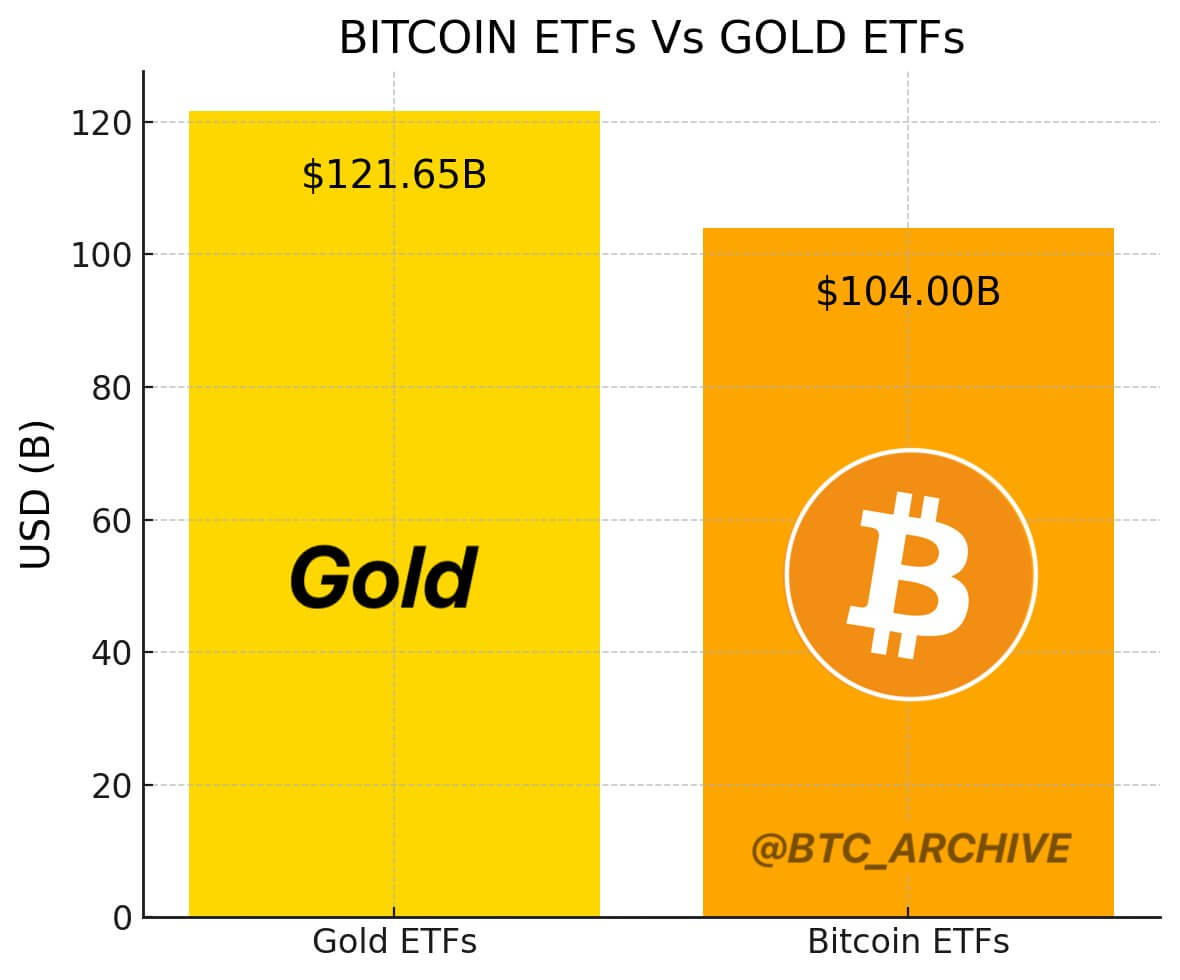

Spot Bitcoin exchange-traded funds (ETFs) have achieved a significant milestone, surpassing $100 billion in net assets. This accomplishment, as reported by SoSoValue data, represents 5.4% of Bitcoin’s total market value.

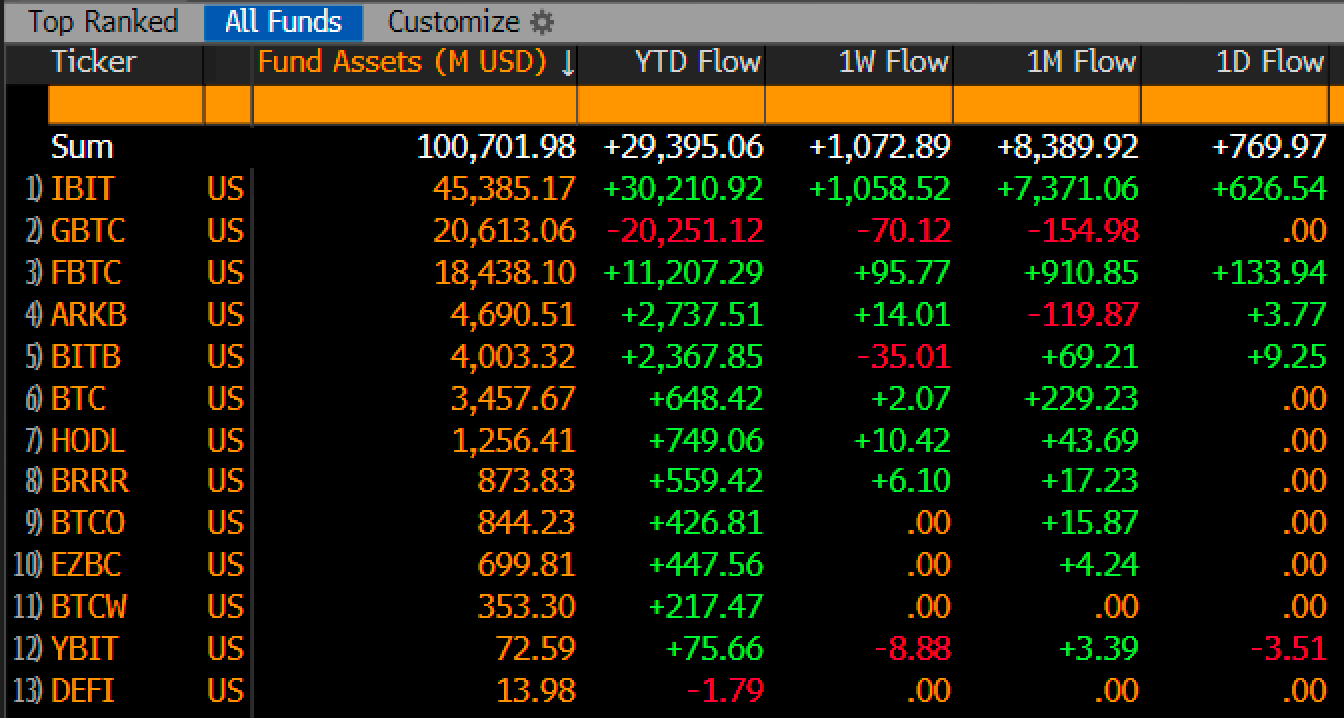

Key Players in the Spot Bitcoin ETF Market

- BlackRock’s iShares Bitcoin Trust (IBIT) manages $45.4 billion in assets.

- Grayscale’s GBTC holds the second spot with $20.6 billion in assets.

- Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows in third place with $18.4 billion.

- The Ark 21 Shares BTC ETF (ARKB) stands at $4.6 billion in assets.

- Bitwise BITB rounds up the list with $4 billion in assets.

The rapid growth of spot Bitcoin ETFs positions them as one of the most successful fund categories to date. Bloomberg ETF analyst Eric Balhcunas mentioned that these funds are on track to surpass Satoshi Nakamoto as the largest Bitcoin holder and are steadily approaching the asset value of gold ETFs.