Bitcoin ETF Market Sees Significant Shift: Net Outflows Recorded

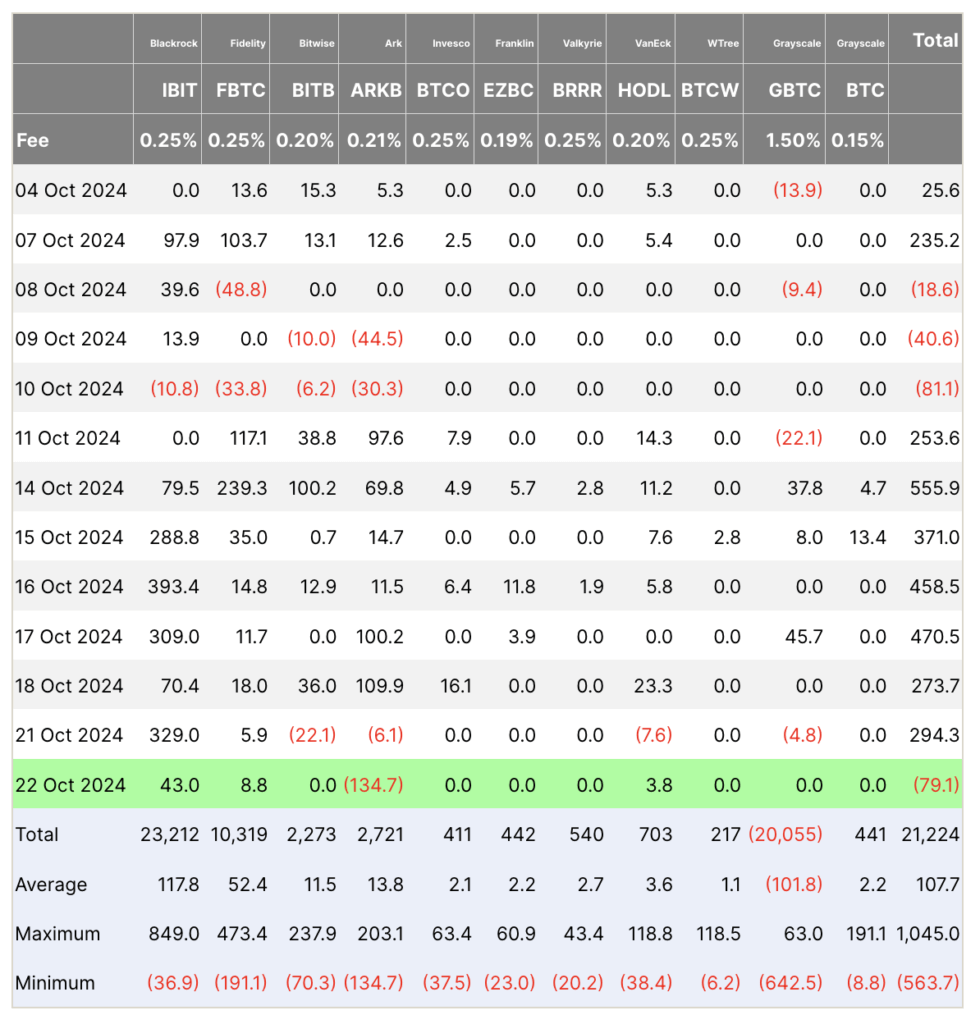

On October 22, 2024, Bitcoin exchange-traded funds (ETFs) experienced a notable change in momentum, recording net outflows for the first time since October 10. This marked the end of a consistent seven-day influx period that had resulted in over $2.6 billion in net inflows.

Key Figures from October 22, 2024

- Total outflow: $79.1 million

- Inflows for iShares Bitcoin Trust (IBIT): $43 million

- Outflows for ARK’s Bitcoin ETF (ARKB): $134.7 million

- Minor inflows observed in Fidelity’s FBTC and VanEck’s HODL

The recent outflows contrast sharply with the trend of strong investor interest in Bitcoin ETFs that had been established over the previous week. Analysts will be closely observing whether this momentary decline indicates a temporary fluctuation or the onset of a new trend in investor behavior.

Market Implications

The performance and resilience of leading ETFs, particularly the iShares Bitcoin Trust, will play a crucial role in determining the direction of future market movements. Investors and analysts alike are keen to decipher the underlying factors driving this recent change.