Current Asset Overview of World Liberty Financial (WLFI)

On the first day of its sales, the Trump-affiliated World Liberty Financial (WLFI) contract wallet, identified by the address 0x5be9a495, amassed assets valued at approximately $11,589,118. A significant portion of this portfolio consists of Ethereum (ETH), which represents 71.72% of the total assets, equating to over $8.3 million.

Asset Composition

- Ethereum (ETH): 71.72% (~$8.3 million)

- Tether USD (USDT): 20.60%

- USDC: 7.20%

Token Ownership Distribution

Analysis reveals that the top 100 token holders command an astonishing 99.56% of the total WLFI supply. This supply totals 100 billion WLFI tokens, with 8,755 individual holders making up an additional 23.292% of the total.

Key Holders

- Main Holder: A Gnosis safe contract wallet holding 47.5% of the tokens.

- Significant Distribution Wallet: Address 0xe217E, which controls 19.2382%.

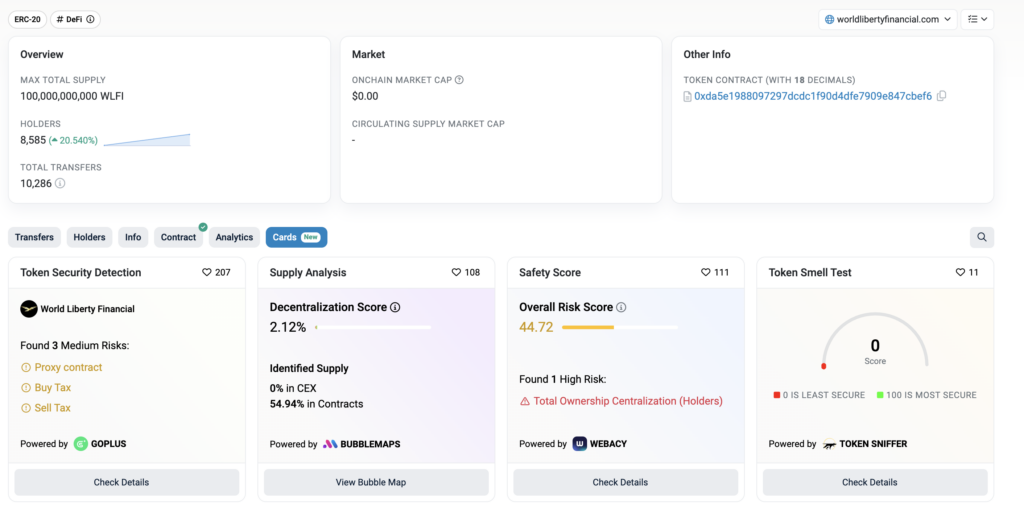

Decentralization and Risk Assessment

According to Etherscan, WLFI’s decentralization score is at 2.12%, indicating a high concentration of token ownership typical among newly launched tokens. This level of ownership centralization poses potential governance challenges.

Ownership Insights

- Overall Risk Score: 44.72 (suggests significant centralization concerns).

- Tokens in Centralized Exchanges: None reported.

- Contract Holdings: 54.94% of tokens stored in contracts.

The current concentration among a handful of wallets could have serious implications for governance and future token sales, as it directly impacts the ability to vote on future decisions.

Sales Objectives

The project’s ambitious goal is to raise $300 million through token sales, and as of the end of the first day, they have achieved 3.8% of this target.

This rewritten content maintains the essential information from the original article while featuring optimized headings, subheadings, and bullet points for better readability and organization.