Recent Trends in Bitcoin’s Profit-Taking Behavior

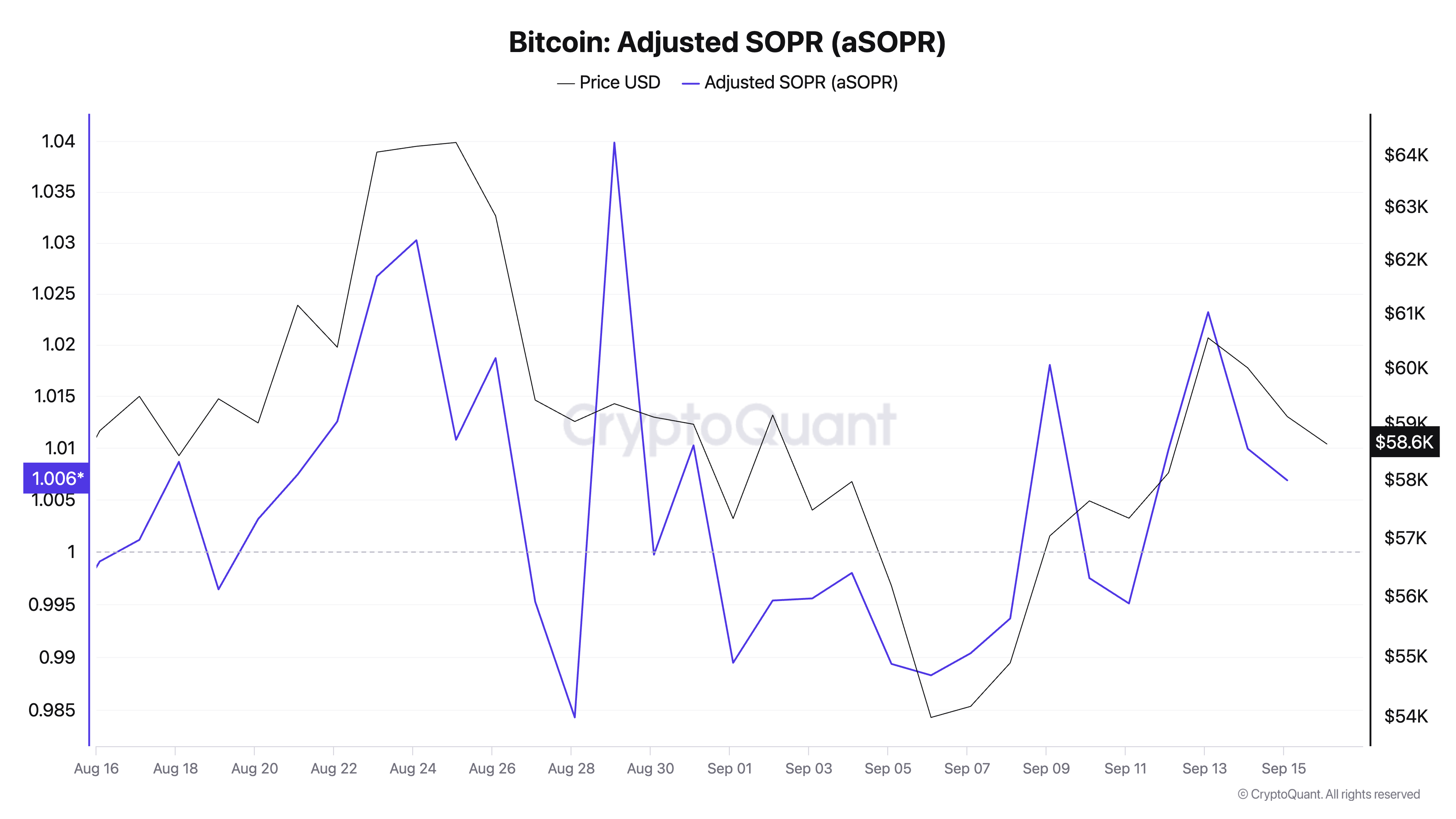

In the past week, the analysis of the spent output profit ratio (SOPR) suggests that the Bitcoin market is currently experiencing a profit-taking phase, primarily driven by long-term holders. During the period from September 6 to September 13, Bitcoin saw a significant surge in price, rising from $53,900 to $60,500. This rally was accompanied by a rise in the adjusted SOPR (aSOPR), indicating that the coins cashed out during this timeframe were predominantly sold at a profit.

Weekend Market Consolidation

Over the weekend, Bitcoin consolidated around the $58,900 mark, leading to a slight decline in aSOPR. This minor dip suggests a temporary pause in profit-taking activities rather than a trend toward incurred losses. The market appears to be stabilizing, indicating a short-term equilibrium rather than a significant change in market sentiment.

Insights from the SOPR Ratio

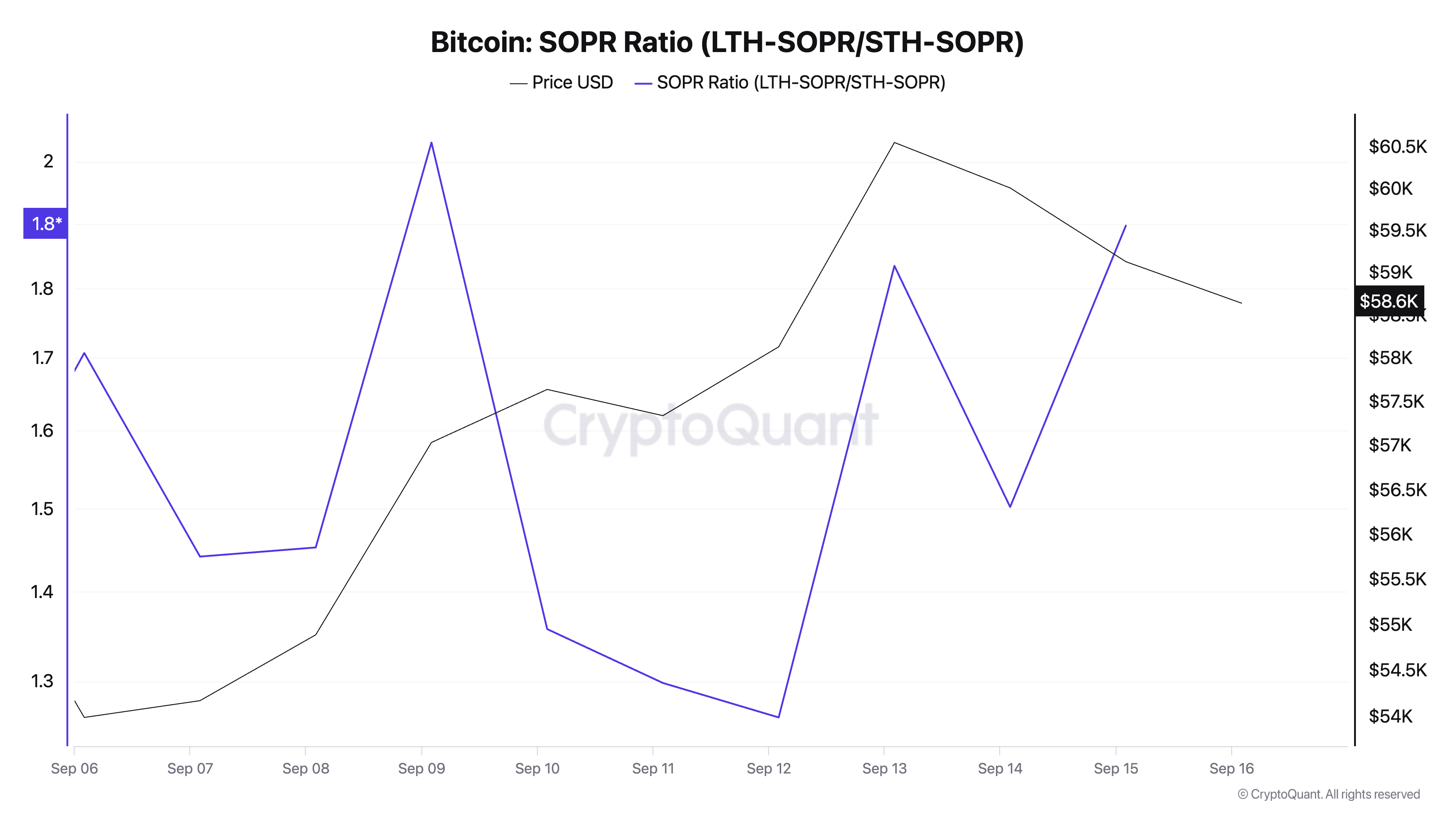

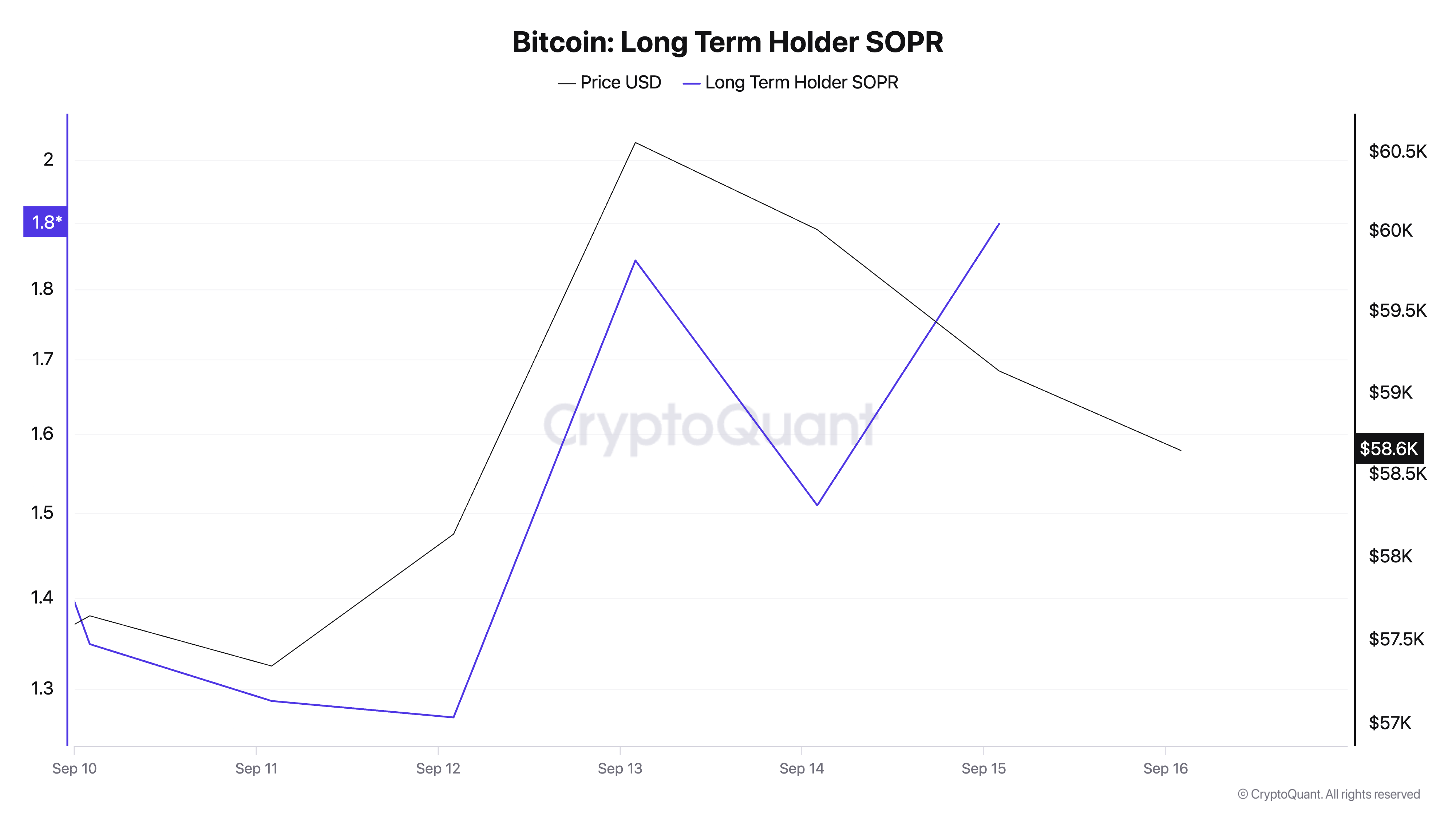

The analysis of the SOPR Ratio, which compares the profitability between long-term and short-term holders, highlighted a marked increase from September 12 to September 15. This spike suggests that long-term holders are actively realizing profits. Historically, such behavior may indicate a potential market peak or a consolidation phase.

Short-Term vs. Long-Term Holder Trends

During the same timeframe, the SOPR for short-term holders experienced a slight uptick, indicating a shift from marginal losses to break-even points. However, long-term holders demonstrated a more strategic approach by capitalizing on price increases to secure substantial profits.

Conclusion

Overall, the current data points to a profit-taking environment led by long-term Bitcoin holders. While this suggests strong bullish sentiment within the market, the increasing SOPR Ratio may serve as an early indication of a nearing short-term peak or a period of potential consolidation ahead.