Recent Trends in Bitcoin Transactions: A Summary

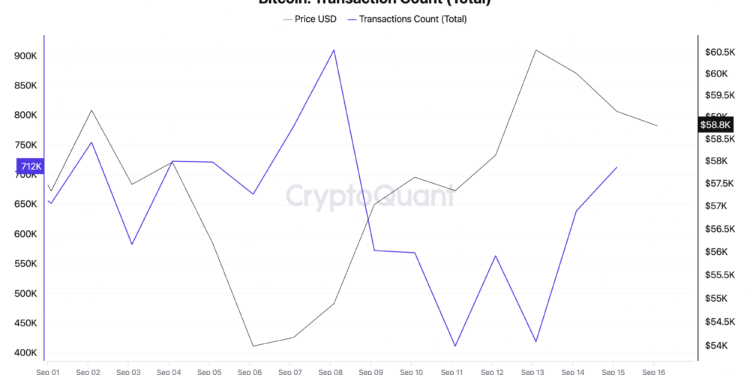

In the past week, Bitcoin has experienced a significant decline in transaction volume, illustrating a market that has momentarily cooled down. Between September 8 and September 11, the number of transactions plummeted from over 909,000 to approximately 412,000.

Market Activity and Its Impacts

This sharp drop correlates with an overall decrease in network activity, likely triggered by a reduction in trading volume following a brief period of saturation in the market. However, by September 15, Bitcoin’s transaction numbers rebounded to around 712,000. This recovery suggests that Bitcoin’s surge past the $59,000 mark has helped revitalize some of the previously stagnant trading volume.

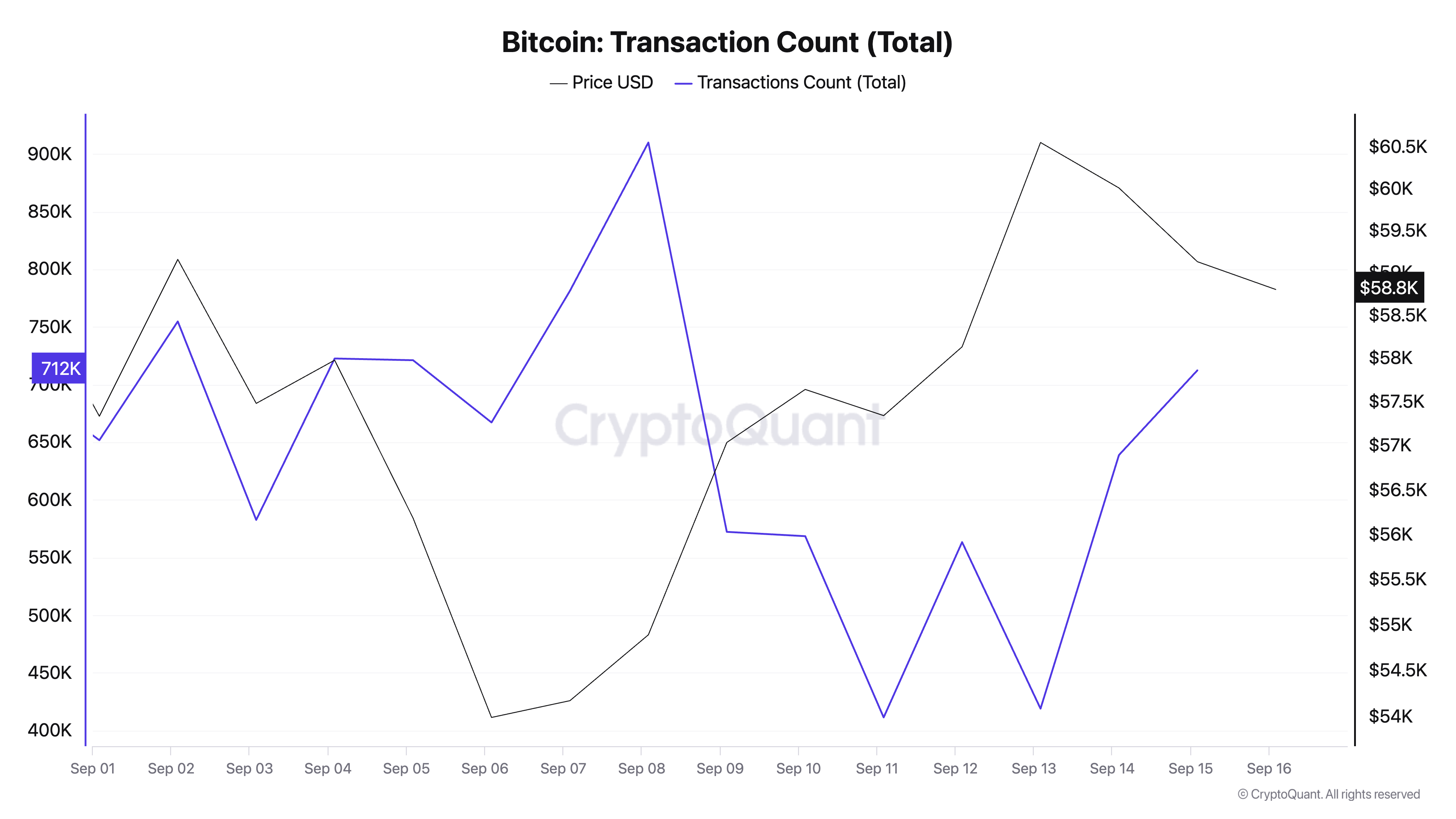

Tokens Transferred: A Decline in Large Transactions

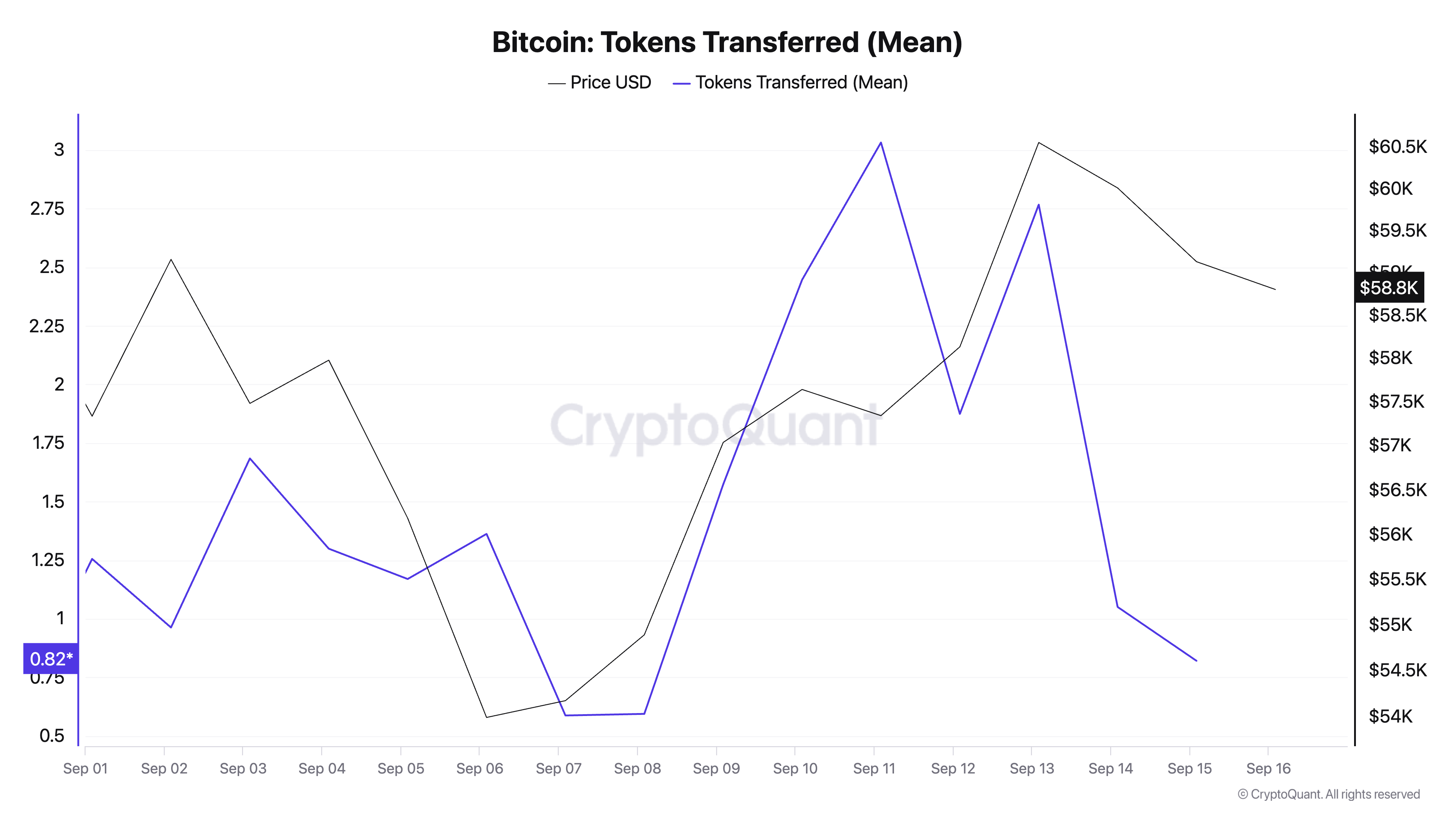

The number of tokens transferred also saw a downward trend, decreasing from 1.39 million on September 8 to 548,518 by September 15. This decline indicates a shift in large-scale transfers, suggesting a reduction in institutional activity or liquidity within the market. Overall, it reflects a period where market participants were less involved in significant transactions.

Analysis of Token Transfer Dynamics

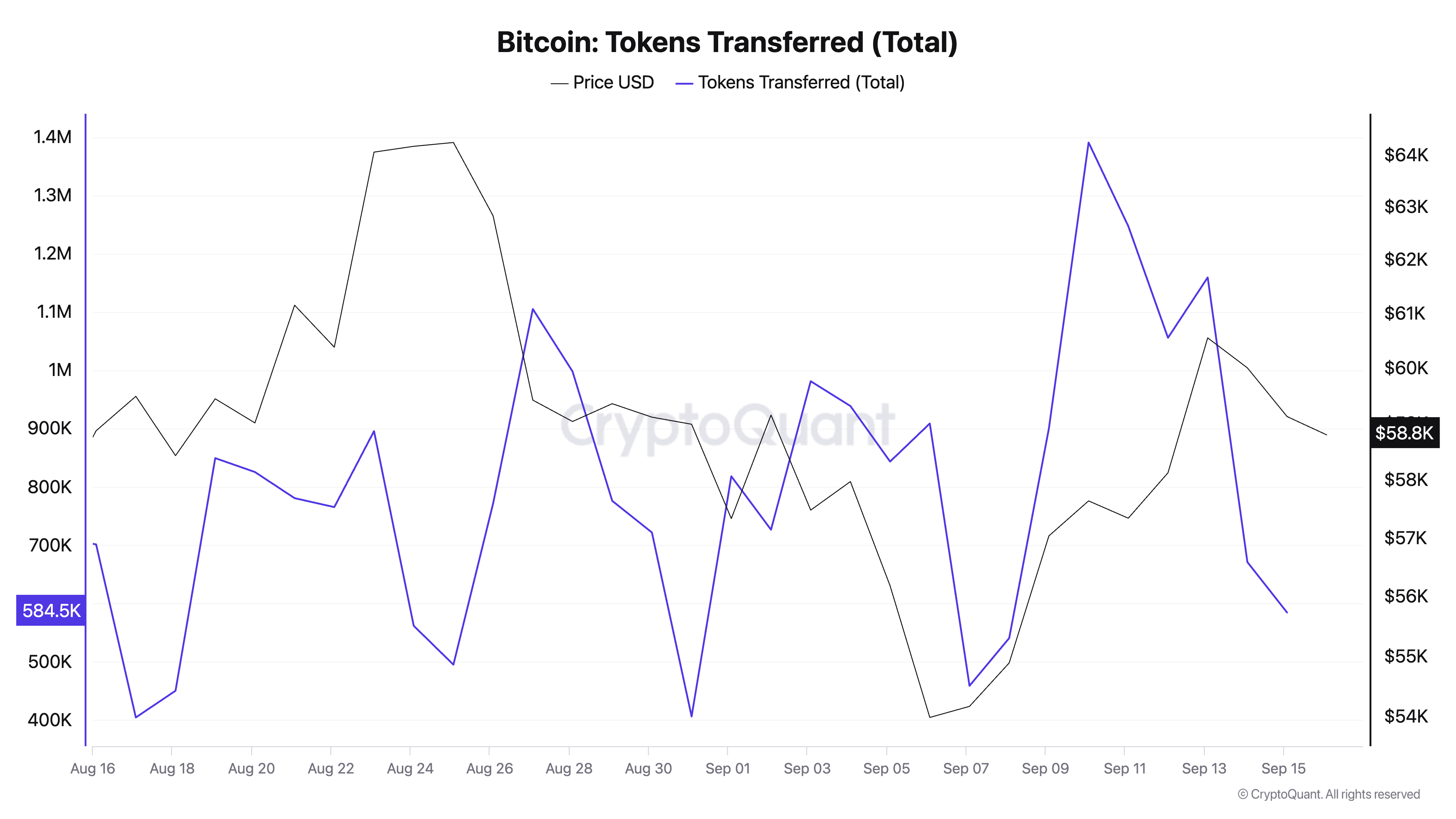

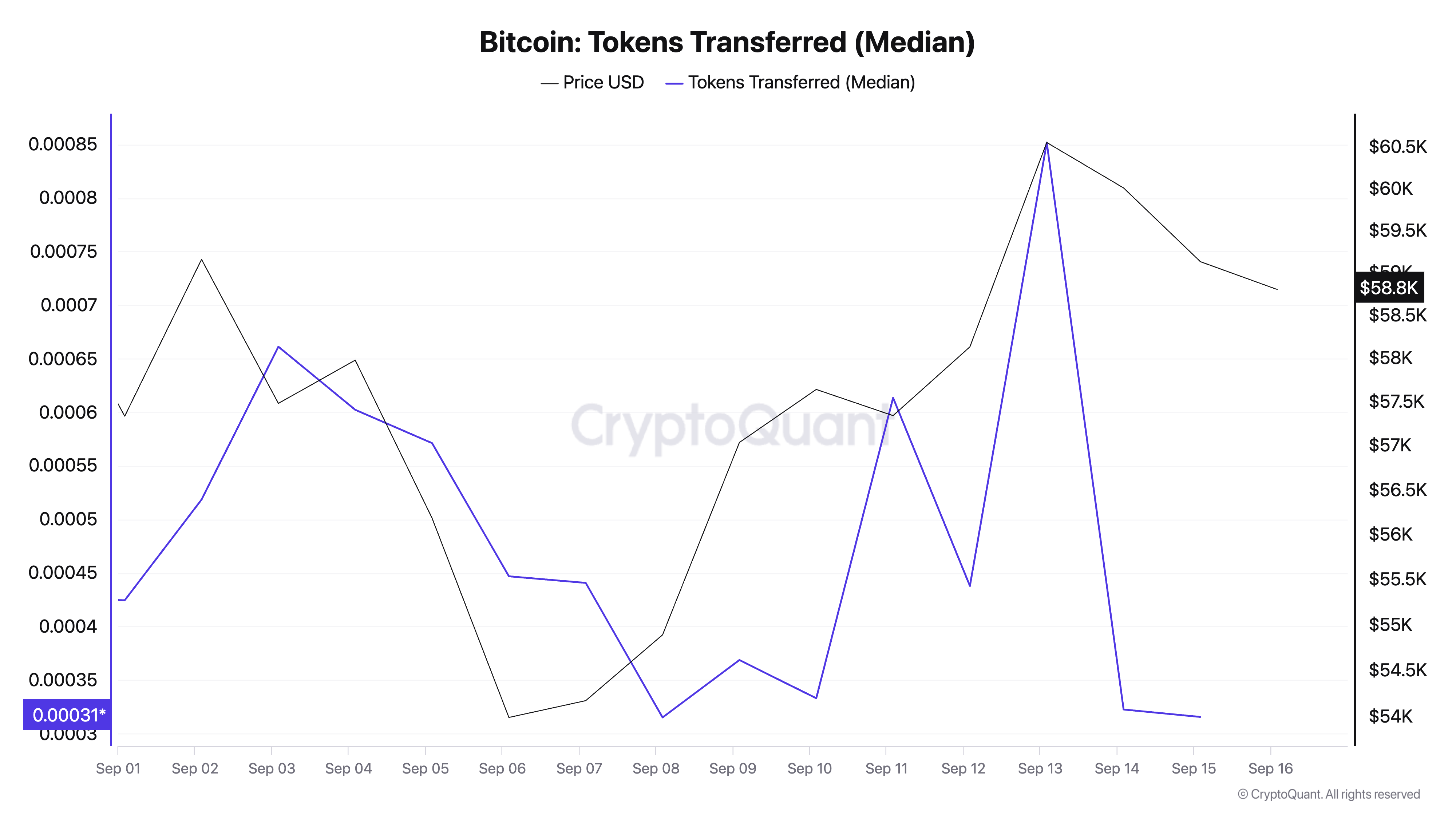

Diving deeper into the metrics, the median number of tokens transferred per transaction on September 8 stood at 0.0008 BTC, with a mean of 0.594 BTC. This disparity suggests that while the majority of transactions involved smaller amounts, a significant number of high-value transactions dominated the statistics.

Trends in Institutional Transactions

A noticeable rise in the mean transaction value to 3.032 BTC on September 11 indicates a period dominated by larger transactions, likely facilitated by institutional investors or cryptocurrency whales. However, by September 15, the mean transaction value dropped to 0.820 BTC, while the median reduced to 0.0003 BTC. This shift suggests a return to more standard trading patterns and a decrease in large-scale transfers.

Conclusion

Overall, the current data highlight a Bitcoin market characterized by intermittent surges in large transactions, interspersed with phases of reduced engagement. This pattern showcases the impact of major players on market sentiment, even amidst steady trading activities from retail and small-scale investors.