Analysis of Bitcoin Transaction Fees in September

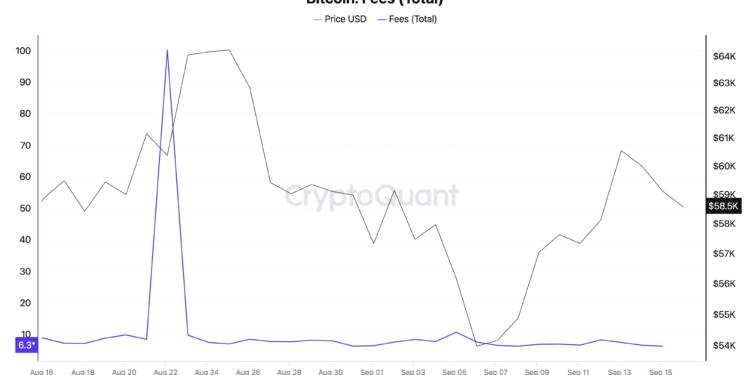

During September, Bitcoin transaction fees exhibited surprising stability following a noteworthy surge in late August. On August 22, transaction fees soared to an astounding 100 BTC (approximately $6.08 million), marking a dramatic increase from the typical range of 6 to 9 BTC that had been observed over the preceding two months.

Understanding the Surge

This abrupt rise in fees led to a significant change in the fees-to-reward ratio, which jumped from 0.018 to 0.167. This indicates a temporary spike in network activity.

Possible Causes of Increased Fees

The sudden increase in transaction fees likely stemmed from a temporary event such as a surge in transaction volume or network congestion. Users were willing to pay higher fees to ensure that their transactions were prioritized. This sharp increase appears to be an anomaly rather than a reflection of a sustained change in market dynamics.

Return to Stability Post-Peak

Following the peak on August 22, transaction fees quickly reverted to their typical range, indicating a swift correction in the market. Despite ongoing price volatility in Bitcoin, this rapid return to stability suggests that the spike in fees was not driven by a fundamental change in transaction demand.

Context of Price Fluctuations

Throughout September, Bitcoin fees remained low and stable, even amidst price fluctuations. This divergence indicates that the price changes were likely influenced by factors beyond on-chain activity, such as derivative trading and broader economic conditions. The data suggests a market preference for holding assets rather than engaging in transactions during this time, indicating that on-chain activities played a minimal role in impacting Bitcoin’s price movements.