Analyzing Bitcoin’s Historical Trends: September Slowdowns and Year-End Surges

By Andjela Radmilac · 4 days ago

The latest market analysis by CryptoSlate provides an in-depth exploration of Bitcoin’s monthly and quarterly performance from 2013 to 2024. This report aims to evaluate the possibility of recurring patterns in Bitcoin’s price movements as we approach 2024.

Understanding Bitcoin’s Monthly Performance

Bitcoin has exhibited distinct trends during specific months over the years. Notably:

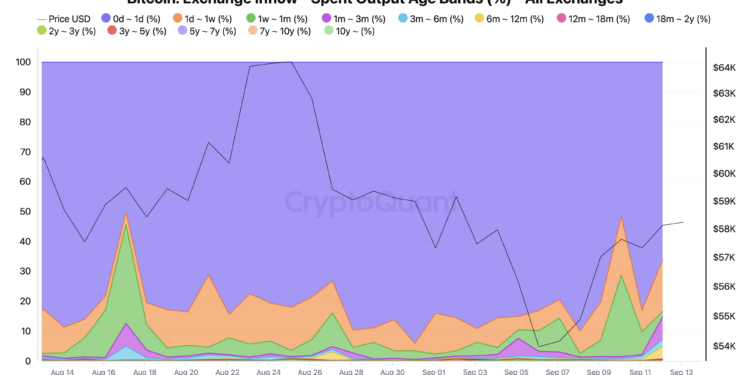

- September Declines: Historically, September has been one of the weaker months for Bitcoin, often experiencing price drops.

- Year-End Rallies: Counterbalancing the September dips, Bitcoin has frequently ended the year on a positive note, with significant rallies in the last quarter.

Key Historical Insights from 2013 to 2024

The analysis spans over a decade, shedding light on Bitcoin’s volatile journey. Key takeaways from the data include:

- Previous Trends: Consistency in the pattern of September dips followed by year-end rebounds.

- Market Sentiment: How external factors and overall market sentiment have influenced these trends, making it crucial for investors to remain informed.

Looking Ahead: What to Expect in 2024

As 2024 approaches, analysts are scrutinizing historical data to predict whether similar patterns will emerge. Key factors to consider include:

- Market Dynamics: The evolving landscape of cryptocurrency markets.

- Regulatory Developments: Potential regulatory changes that could impact Bitcoin’s price trajectory.

Conclusion

Bitcoin’s historical performance reveals a compelling narrative of volatility, with September often marking a downturn followed by a recovery by year-end. As we prepare for 2024, understanding these patterns may help investors strategize effectively in the ever-changing crypto market.