Coinbase has introduced a new wrapped Bitcoin product called cbBTC, achieving remarkable acceptance within just 24 hours, leading to a market cap nearing $100 million.

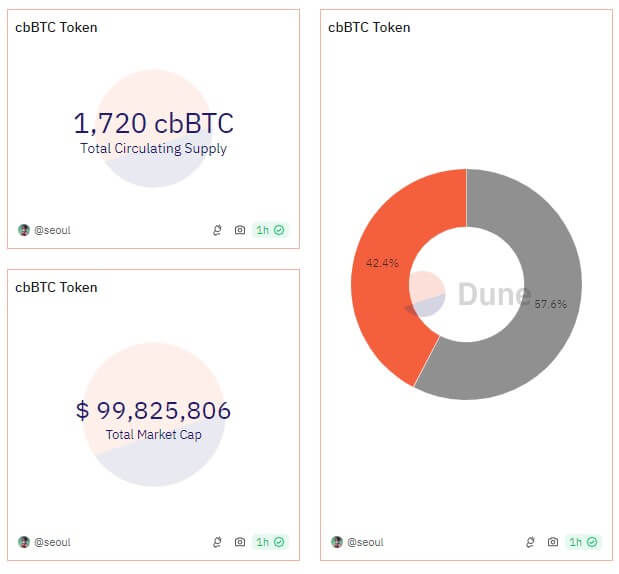

According to Dune Analytics, the cbBTC circulating supply has reached 1,720 tokens, with a valuation of approximately $99.8 million. Notably, 43% of this supply is based on Base, while 57% is on Ethereum.

Growth of DeFi on Base Network

Market analysts believe that the introduction of cbBTC could significantly enhance DeFi activities within Coinbase’s layer-2 network, Base.

Luke Youngblood, a participant in Moonwell DeFi, pointed out that cbBTC’s compatibility with Bitcoin on Coinbase could allow individual BTC holdings, exceeding $20 billion, and institutional investments exceeding $200 billion to integrate smoothly into Base’s on-chain ecosystem.

Additionally, Nansen CEO Alex Alealso commended the swift adoption of cbBTC, predicting it would substantially increase total assets on the Base network. He noted that Coinbase holds approximately 36% of the total supply, while market maker Wintermute holds a significant portion of it. Svanevik remarked:

“It appears that Wintermute is the leading market maker. It could be a lucrative venture for them.”

Criticism Surrounding cbBTC

Despite the initial success of cbBTC, not all voices are in favor of it.

TRON founder Justin Sun has expressed skepticism, labeling cbBTC as “central bank BTC” due to its lack of Proof of Reserve audits and concerns over potential government interference.

He noted:

“cbBTC lacks Proof of Reserve, has no audits, and can freeze any user’s balance at any time. It operates mostly on trust. A US government subpoena could potentially seize all your BTC, which epitomizes central bank Bitcoin. It’s a somber moment for BTC.”

Sun also highlighted that integrating cbBTC into DeFi might pose security threats, as governmental subpoenas could instantly freeze on-chain Bitcoin, compromising the essence of decentralization. He stated:

“Many DeFi protocol founders are my friends, but incorporating cbBTC could create significant security vulnerabilities. A simple government subpoena could freeze on-chain Bitcoin at any moment, rendering decentralization meaningless.”

Some speculate that Sun’s critiques arise from fears that Coinbase’s cbBTC might encroach on the territory of BitGo’s WBTC, a project he is associated with. His connection with WBTC has sparked discussions in the crypto community as some users seek alternative options.