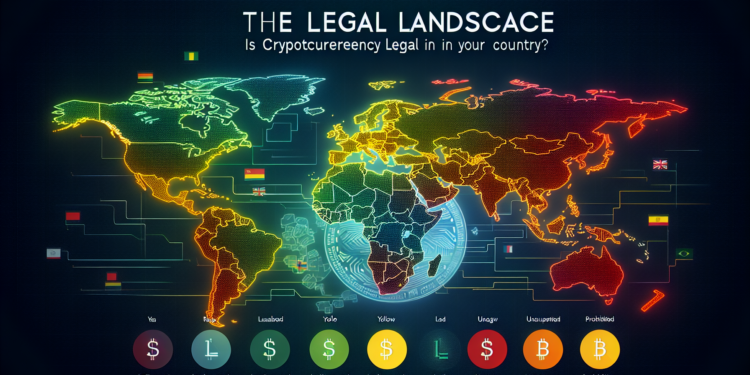

As digital currencies gain momentum and become more integrated into global economies, questions about their legality have surged. Cryptocurrencies, which utilize blockchain technology to facilitate secure transactions, are at the forefront of a new financial revolution. However, the legal status of these assets varies significantly across different jurisdictions. In this article, we explore the legal landscape of cryptocurrency, highlighting how various countries approach its use, regulation, and taxation.

Understanding Cryptocurrency Regulation

Cryptocurrency regulations primarily focus on three core areas: legality of use, regulatory frameworks for exchanges, and taxation. Governments worldwide grapple with how to address these multifaceted issues amid a rapidly evolving digital economy. While some countries embrace cryptocurrencies and create favorable regulations, others impose strict bans due to concerns over security, fraud, and tax evasion.

The Pro-Crypto Countries

-

United States: The legal status of cryptocurrency in the U.S. is complex, with laws varying by state. While the U.S. Commodity Futures Trading Commission (CFTC) classifies Bitcoin as a commodity, the Securities and Exchange Commission (SEC) considers certain cryptocurrencies as securities. This duality creates a challenging environment for crypto businesses and investors but also fosters innovation within clear guidelines.

-

European Union: The EU is taking significant steps towards a unified regulatory framework for cryptocurrencies. The Markets in Crypto-Assets (MiCA) regulation, expected to be implemented soon, aims to create a cohesive approach to crypto assets across member countries. While some countries like Germany and France have established regulations permitting the use of cryptocurrencies, others remain uncertain.

-

Switzerland: Known for its progressive stance on cryptocurrencies, Switzerland classifies cryptos as "assets" and offers a favorable regulatory environment. The Swiss Financial Market Supervisory Authority (FINMA) provides clear guidelines for ICOs and cryptocurrencies, fostering a welcoming atmosphere for innovation and investment.

- Singapore: Singapore has emerged as a global crypto hub thanks to its clear regulatory framework established by the Monetary Authority of Singapore (MAS). The Payment Services Act regulates digital payment tokens, facilitating safe and compliant operations for exchanges and users alike.

The Cautious Approach

-

Canada: In Canada, cryptocurrency is legal, but its regulation falls under existing securities laws. Regulatory bodies monitor exchanges and require compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, ensuring a controlled environment for crypto businesses.

-

Australia: Australia recognizes cryptocurrencies as legal and has implemented robust regulations for exchanges and initial coin offerings (ICOs). The Australian Transaction Reports and Analysis Centre (AUSTRAC) oversees compliance, providing a framework that encourages innovation while enhancing security.

- United Kingdom: The UK has welcomed cryptocurrencies into its financial landscape; however, regulatory oversight exists. The Financial Conduct Authority (FCA) requires exchanges to register and comply with anti-money laundering regulations, creating a balance between innovation and consumer protection.

The Restrictive Environments

-

China: China has taken a hard stance against cryptocurrencies, banning ICOs and crypto trading platforms since 2017. Although the central government promotes blockchain technology development, cryptocurrencies are viewed as a threat to financial stability and control.

-

India: India’s regulatory stance on cryptocurrencies has been tumultuous, oscillating between potential bans and regulatory frameworks. While the Reserve Bank of India initially restricted banks from dealing with crypto businesses, the Supreme Court overturned this ban in 2020. As of now, discussions are ongoing regarding potential taxation and regulation.

- Russia: Russia’s approach to cryptocurrency is ambiguous. While the government has not outright banned cryptocurrencies, it has placed restrictions on their use for payments. The Central Bank has voiced skepticism about digital currencies, urging the need for comprehensive regulation.

Implications for Investors and Businesses

Understanding the legal landscape is crucial for investors and businesses engaged in cryptocurrency. Operating in jurisdictions with favorable regulations can enhance business opportunities and legitimacy, while restrictive environments may hinder growth and innovation. Investors must remain vigilant and informed about local laws to navigate potential legal risks effectively.

Conclusion

The legality of cryptocurrency varies dramatically around the world, underscoring the importance of awareness of local regulations. As more countries navigate the complexities of digital assets, we can see a trend towards more defined regulatory frameworks that aim to balance innovation with security. Whether you are an investor, entrepreneur, or policymaker, staying updated on your country’s legal stance on cryptocurrency is essential for making informed decisions in the evolving digital economy. As the landscape continues to shift, the future of cryptocurrency law will shape the financial systems of tomorrow.