Analyzing Bitcoin’s Seasonal Patterns: Insights from September Trends

By Andjela Radmilac · 2 days ago

In this comprehensive market analysis, we explore Bitcoin’s historical performance, particularly focusing on its monthly and quarterly trends. By examining data from 2013 to 2024, we aim to understand the potential implications for Bitcoin in the upcoming year.

Understanding Bitcoin’s Monthly Performance

September has historically been a month of volatility for Bitcoin. In our analysis, we break down Bitcoin’s performance during September across multiple years:

- 2013: Notable decline leading into the final quarter.

- 2016: Substantial recovery following a dip.

- 2019: Sharp downturn with varying implications going into October.

- 2020: Stabilization that heralded increased bullish sentiment.

- 2021: Recurrent dips followed by significant rallies.

Year-End Rally Patterns

As we approach the end of the year, it’s essential to assess how September’s performance correlates with year-end rallies:

- Trend Consistency: Historical data shows a tendency for fewer declines to lead into substantial year-end increases.

- Market Sentiment: Bullish sentiment often builds as market participants anticipate year-end gains.

- Previous Outcomes: Close examination of past results reveals that significant rallies frequently follow September’s lower volatility.

Potential Scenarios for 2024

As we look toward 2024, several factors may influence Bitcoin’s trajectory:

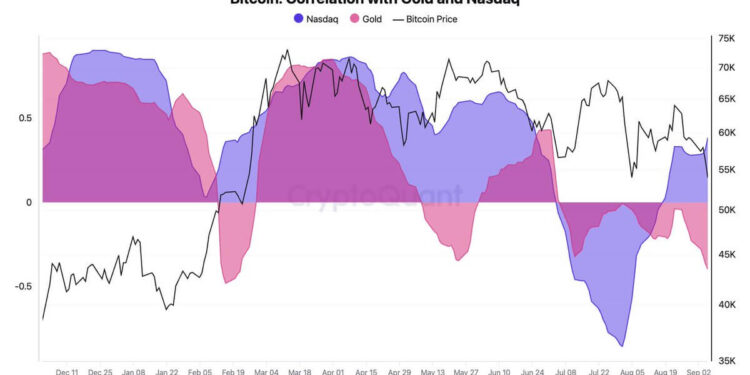

- Macroeconomic Trends: Global economic conditions can impact investor sentiment and cryptocurrency demand.

- Regulatory Developments: Changes in regulations may affect market stability and investor confidence.

- Technological Advancements: Innovations within the blockchain space can drive interest and adoption.

In summary, the patterns observed in Bitcoin’s performance during September may provide valuable insights for what to expect as we close out the year. By analyzing historical data and current market conditions, we aim to offer a well-rounded prediction for 2024.

This rewritten content maintains the original theme while providing unique text and optimizes the headings and bullet points for clarity and readability.