Recent reports indicate that Coinbase, once a dominant player in the U.S. cryptocurrency market, has experienced a notable drop in its market share. According to a study released on September 9 by research firm Kaiko, this decline coincides with the rising influence of smaller exchanges.

Decline of Coinbase’s Market Presence

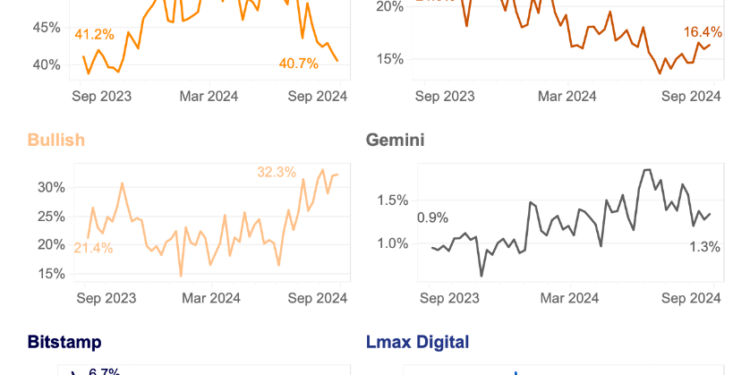

Earlier this year, Coinbase commanded over 50% of the U.S. cryptocurrency market, reaching a peak of approximately 55% in March. By early September, however, its market share had decreased to 41%, down from 53% in June.

The primary beneficiary of this market shift appears to be Bullish, which has seen its market share surge from 17% to 33%. Unlike Coinbase, which primarily caters to retail investors, Bullish focuses on institutional trading.

Founded in 2021 as a division of blockchain firm Block.one, Bullish has received backing from Peter Thiel, a co-founder of PayPal. Recently, the firm generated attention for acquiring the crypto media platform Coindesk.

Top Exchanges Consolidating Market Power

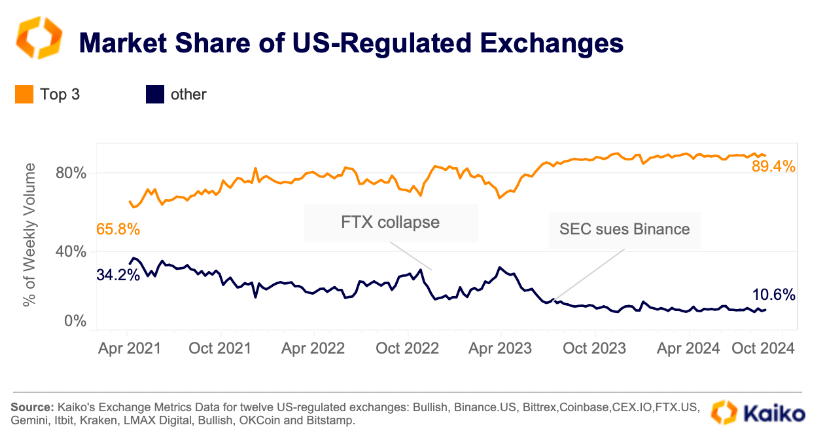

As smaller exchanges struggle, major players in the U.S. cryptocurrency market have significantly strengthened their foothold. Kaiko reports that the three largest exchanges now account for nearly 90% of market trading volume, a substantial increase from 66% recorded in April 2021.

In stark contrast, the combined market share of smaller exchanges has plummeted from 34% to just 11%. Kaiko attributes this trend to several factors, including heightened regulatory scrutiny, reduced trading activity during the bear market of 2022-2023, and the dominance of exchanges like Coinbase and Kraken in the institutional segment.

Furthermore, the sudden collapse of FTX in 2022 and regulatory challenges faced by Binance.US also contributed to the decrease in smaller exchanges’ market share.

Coinbase Stock Performance Overview

The decline in market share for Coinbase coincides with an upgrade of its stock by British bank Barclays, which moved COIN from an underweight to an equal weight rating.

Barclays analyst Benjamin Budish noted that Coinbase has demonstrated significant growth through an expansion of its product offerings and improved economic conditions. He suggested that the exchange might thrive in a more favorable regulatory landscape, especially with potential support from upcoming U.S. presidential candidates for the cryptocurrency sector.

However, Budish warned that uncertainties persist, particularly concerning the broader economic context and ongoing regulatory hurdles, notably the unresolved lawsuit with the Securities and Exchange Commission (SEC) that looms over Coinbase’s operations.

Despite these challenges, Coinbase’s stock reportedly rose about 5% in early trading. Yet, the company’s stock is down approximately 10% year-to-date, as noted in recent TradingView data.