Understanding Ethereum’s Current Inflationary Period

Ethereum has been experiencing a prolonged inflationary period, with over 350,000 ETH (equivalent to approximately $1.1 billion) added to its circulating supply since the March Dencun upgrade. This has resulted in Ethereum’s current inflation rate standing at 0.35%.

Supply Statistics

The recent increase in supply has pushed the total number of ETH to 120.4 million, leaving just under 95,000 ETH to match the levels observed at the Ethereum Merge in September 2022.

The Impact of Dencun on Ethereum’s Supply Dynamics

The Dencun update brought about significant changes that altered Ethereum’s base fee burn rate. By allocating specific block space for layer-2 networks to process bundled transactions, known as blobs, competition for mainnet block space was reduced. Additionally, the proto-danksharding mechanism made data availability more efficient, leading to a sharp drop in base fees.

These changes have significantly affected transaction fees on the Ethereum network, resulting in more ETH being issued than burned in most blocks.

For instance, over the last 30 days, Ethereum burned 45,022 ETH while issuing 78,676 ETH, leading to a net supply increase of over 30,000 ETH, highlighting the inflationary impact of the reduced base fee environment.

The Role of Staking in Ethereum’s Inflationary Pressure

The rise in Ethereum’s inflationary pressure is also tied to the increasing ETH staking ratio. Analysts have noted that the Dencun upgrade has had a significant impact on Ethereum’s ecosystem, but broader factors, such as the rising ETH staking ratio, are accelerating token issuance.

Ethereum’s transition to Proof of Stake (PoS) has enhanced network security and participation but has also resulted in more ETH being issued. Validators locking up their ETH to secure the network earn rewards in newly minted tokens.

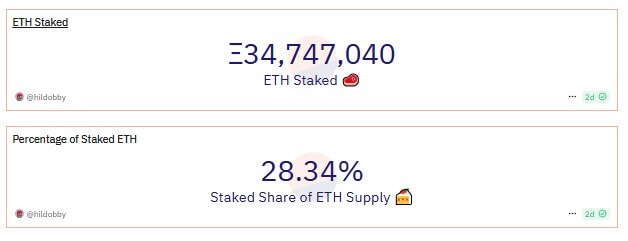

According to Dune Analytics data, approximately 34.7 million ETH, around 28% of the total supply, is currently staked. This staked ETH plays a crucial role in securing the network and generating rewards, further contributing to Ethereum’s supply.

The trend of restaking, particularly with protocols like EigenLayer, amplifies this effect. Users reinvesting their staking rewards generate additional ETH, compounding the inflationary impact.